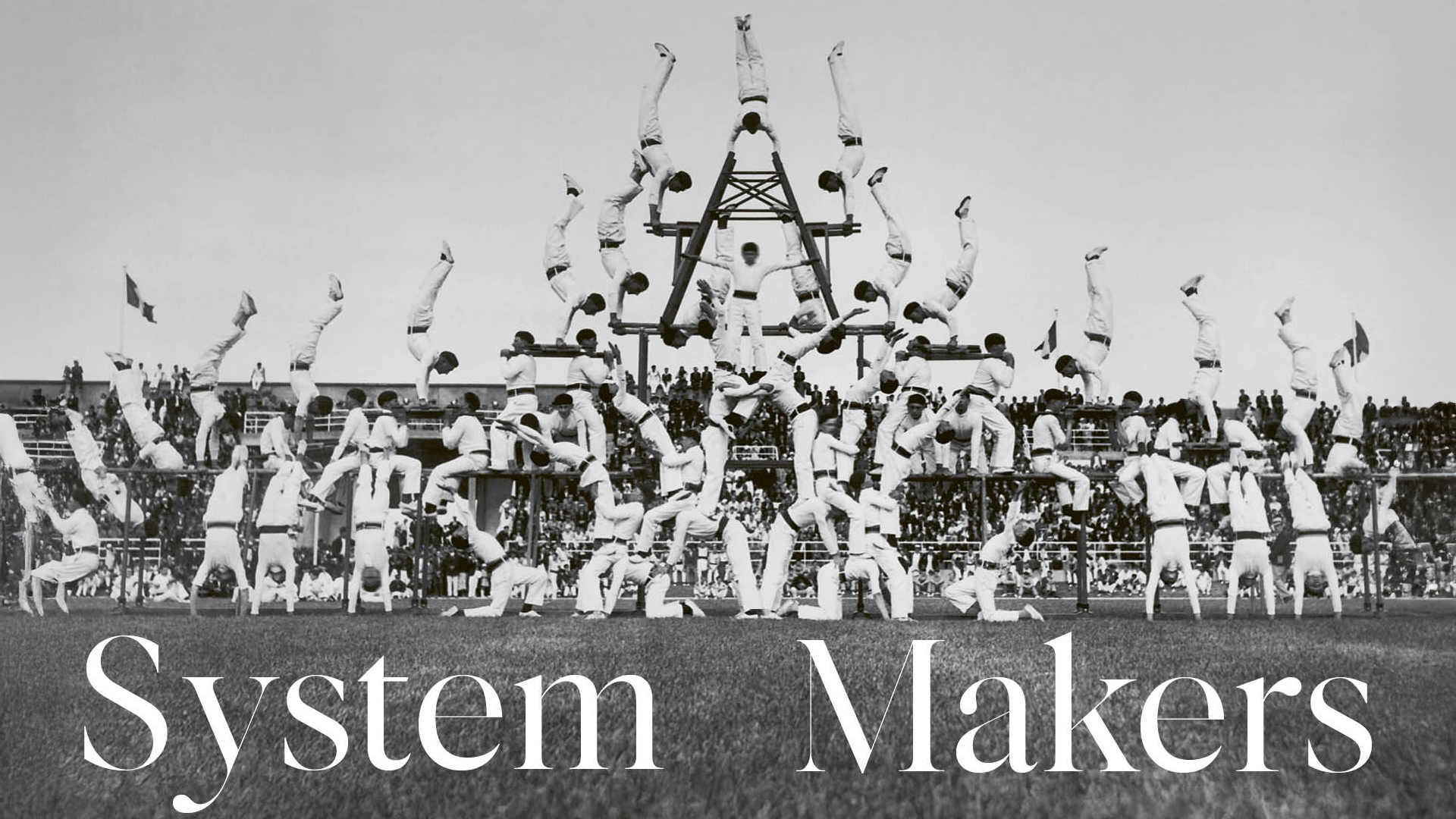

We are the engineers of the capital markets and...

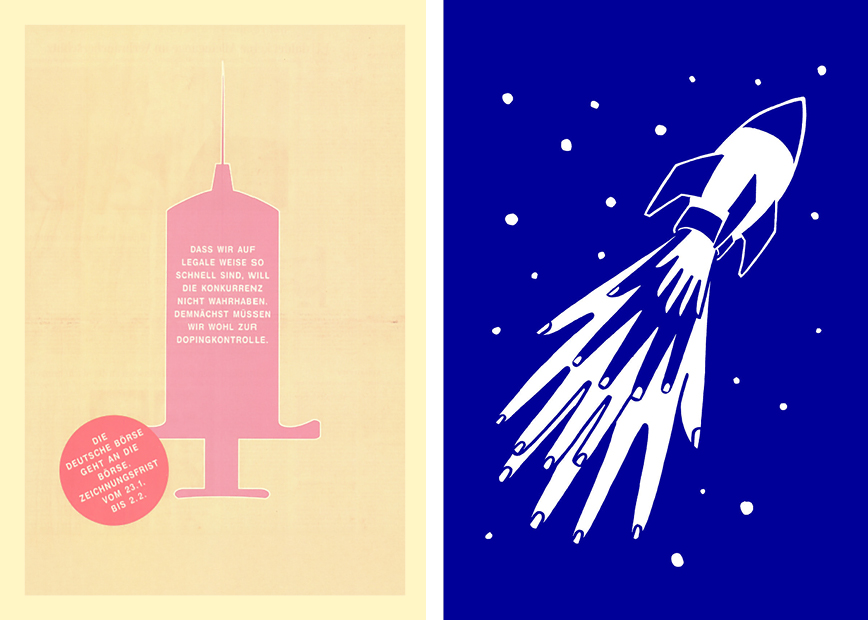

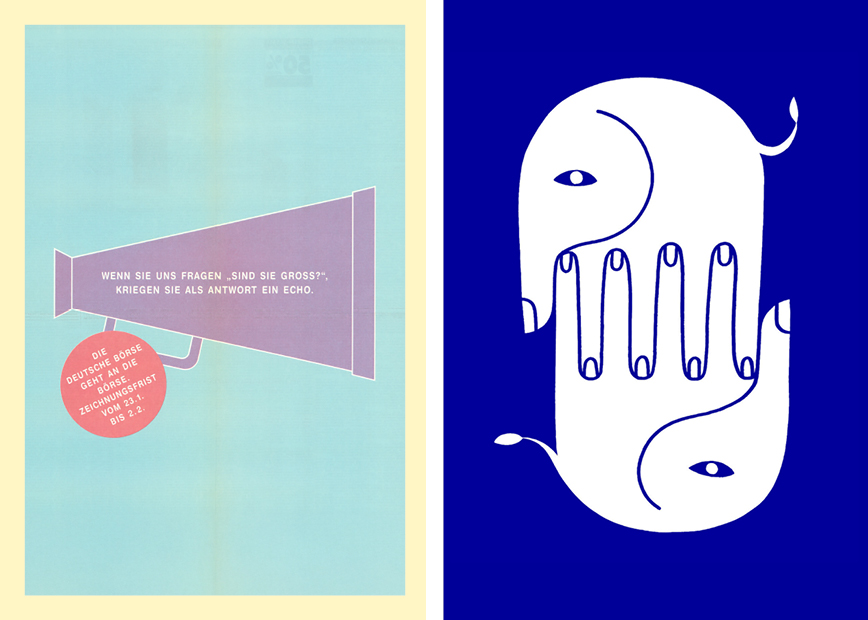

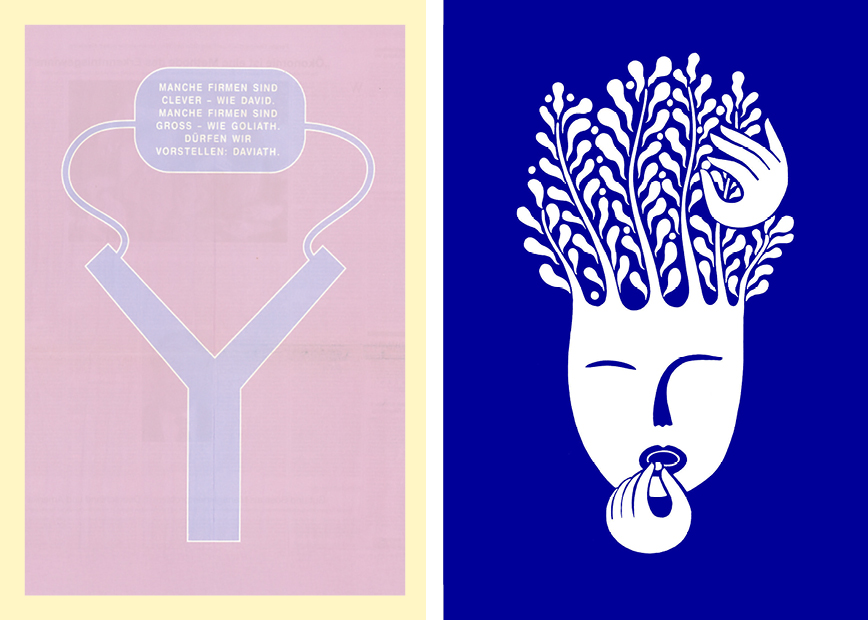

The ad campaign that set Deutsche Börse Group in motion – 25 years on

Acquisitions that contributed to Deutsche Börse Group

Innovations that moved our markets forward

Leading the transformation of global financial markets

“Success lies in getting everyone on board”

In this interview, Stephan Leithner reflects on responsibility, innovation, and the legacy of the IPO. He looks back on 25 years of Deutsche Börse Group’s history – and ahead to how technology, trust, and Europe’s ambition to shape its own future will define the capital markets of tomorrow.

READ MORE