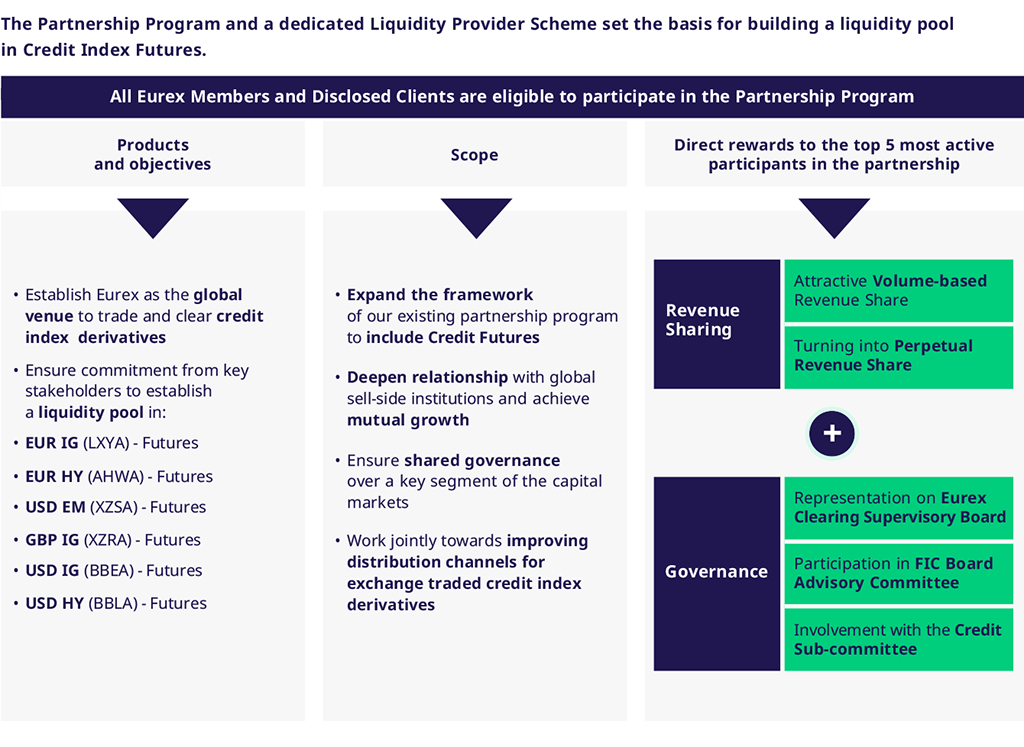

How does Eurex Clearing's Partnership Program work?

The five most active program participants are eligible for a significant share in the economics of the multi-currency interest rate swap offering of Eurex Clearing on a permanent basis. In addition, these clients are included in the governance and committee structure of Eurex Clearing. Participation is open to all Trading and Clearing members and registered clients of Eurex Clearing.

The program’s key elements