Mar 13, 2025

Eurex

Eurex Repo Monthly News February 2025

Market briefing: ''GC Pooling maintained strong momentum, while the Special and GC segment demonstrated notable resilience''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

The European Central Bank's decision to reduce its deposit rate from 3% to 2.75% on January 30th took effect on February 5th.

February versus January also saw notable increases in average daily traded and term-adjusted Special and GC volumes in European Government bonds, alongside record-breaking volumes in SSA.

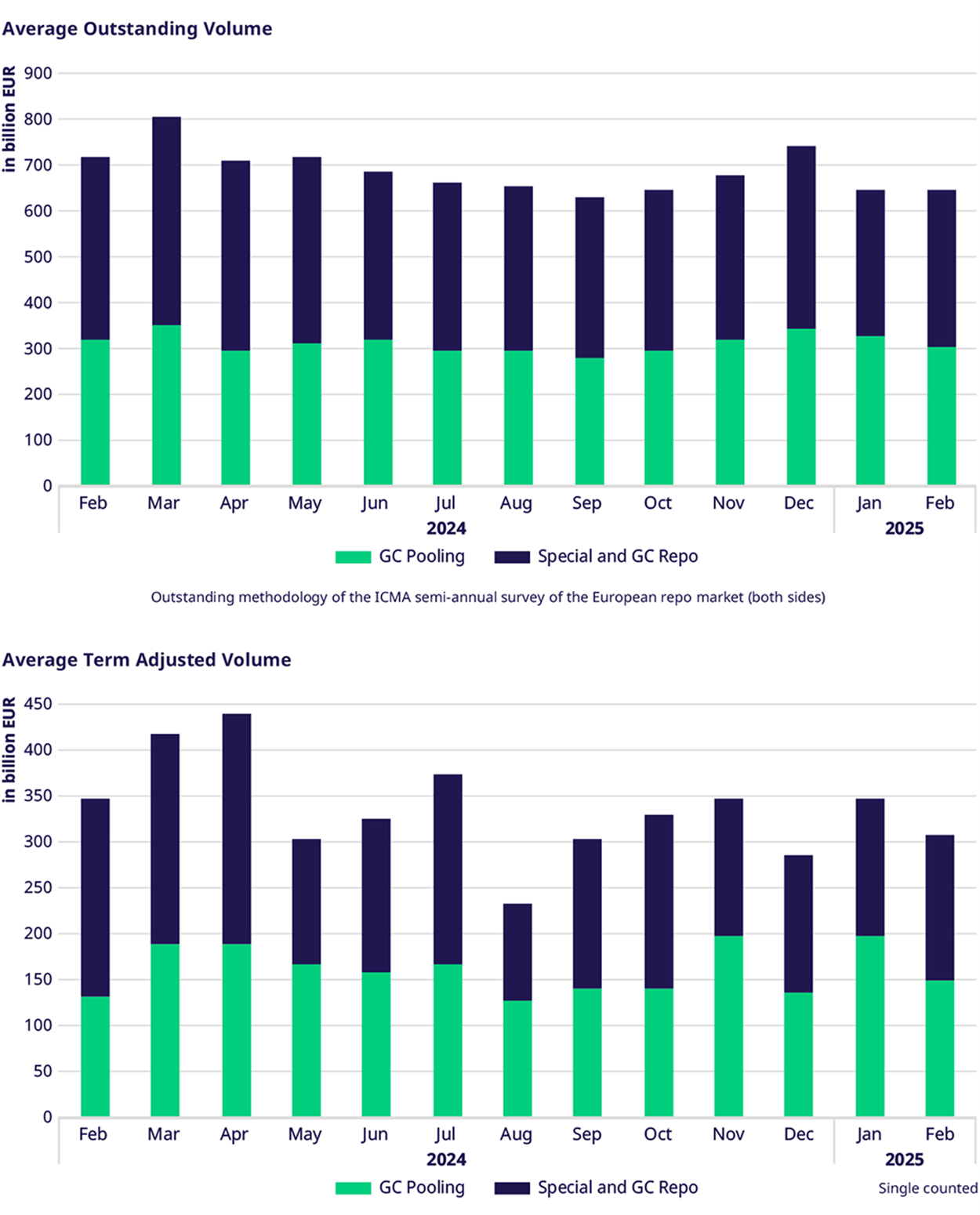

Since the beginning of the year, GC Pooling term-adjusted volumes have risen by 35% compared to the same period in January-February 2024, despite a 28% decrease in GC & Special.

However, compared to January 2025, February's average daily traded volumes demonstrated resilience with a slight increase of 1%. This was driven by a robust 41% increase in GC Repo and a 19% increase in Special average daily traded volume. Traded volumes in SSAs, in both Special and GC formats, reached a new high in February, up 4% from January.

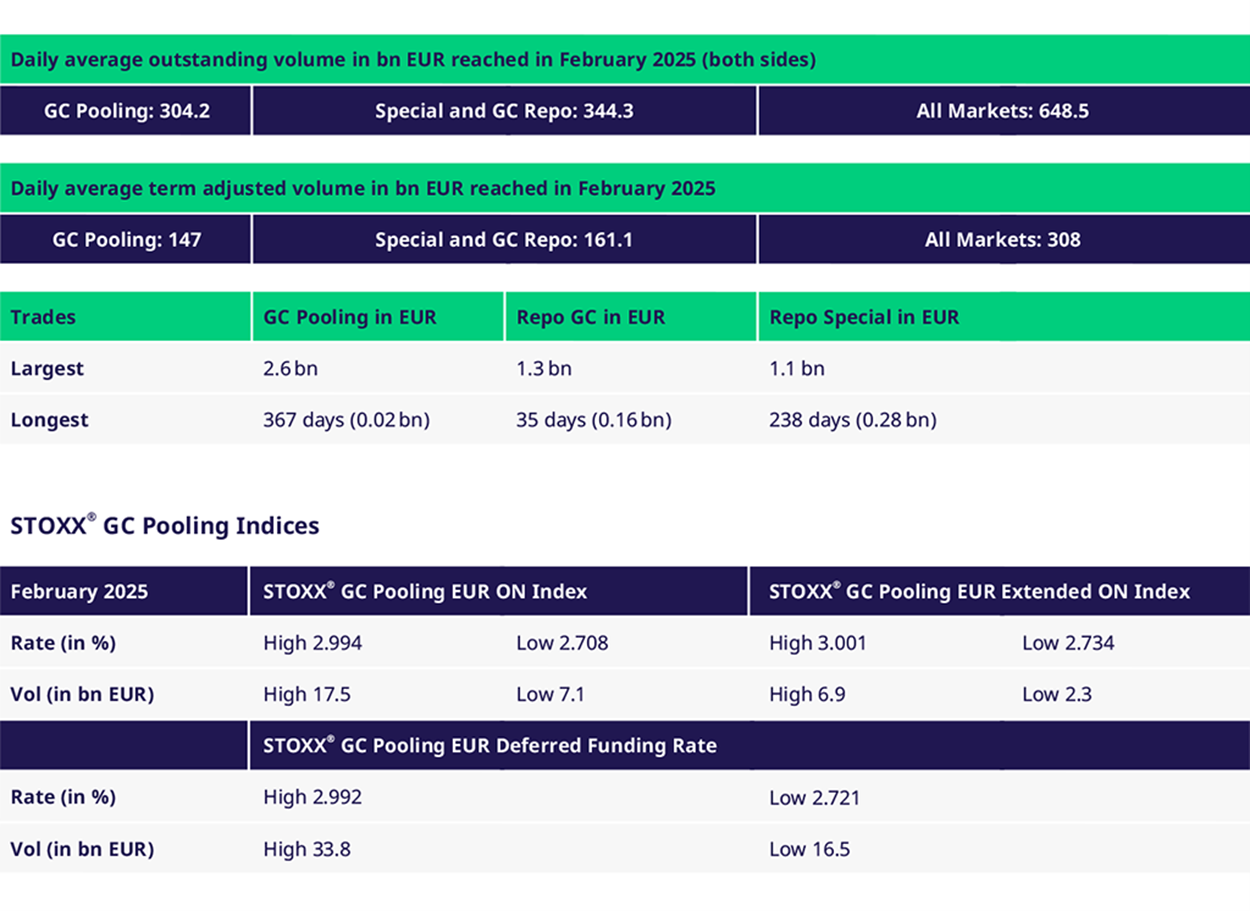

Outstanding and Traded Volumes

In February, average daily traded volumes remained stable, with a slight decrease of 1% compared to February 2024. This was driven by a 9% increase in GC Pooling and a 15% decrease in GC & Special. Overall outstanding volumes fell by 8%, primarily due to a 15% decline in GC & Special, while GC Pooling maintained stable and consistent outstanding volumes.

Spreads and Collateral

The average spread of €STR against Bund single ISIN repos further narrowed in February, reaching less than -3 basis points on February 19th and averaging -4 basis points for the month. The trend observed last month, where Bunds repo premium experienced a mini comeback, has been confirmed this month.

The EUR GC Pooling overnight repo rate corridors between the ECB and EXT ECB baskets remained stable during the month, with the EXT ECB basket experiencing some trading above the deposit rate. The overnight average traded rate in the ECB basket decreased slightly to 2.738%, while the EXT ECB overnight average traded rate reduced by a full basis point to 2.748%, resulting in an average spread of 1 basis point between the baskets.

Eurex Term Repo

In February, the term GC Pooling market experienced active trading across all standard terms from 2 weeks to 12 months in both the ECB and ECB Extended baskets. The ECB MAXQINT basket also saw active trading from 2 weeks to 3 months.

In the Specials market, brisk trading was observed in Euro Government bonds with maturities up to 1 year in Spanish government bonds and in 3-month French government bonds. Elevated volumes of repo specials in SSAs were also noted, with terms up to 6 months. Open rate repos were notable in SSA bonds throughout the month.

GC & Specials

Average daily traded volumes in GC and Special increased by 41% and 19%, respectively, compared to January.

EU Bonds and SSAs

Traded volumes in SSAs traded in both formats, Special and GC, reached a new high of nearly €50 billion in February, up 4% from January, driven by a strong increase in EU Bonds, which rose by 35% compared to January.

Government Bonds

Although average traded volumes in Bunds year-to-date are still 10% lower compared to the same period in 2024, there was a strong recovery in February 2025, with an increase of nearly 30% compared to January. Additionally, average traded volumes in Italian government bonds saw a significant increase of approximately 22%.

Events - save the date

Finadium Rates & Repo Europe

📍 LSEG, 10 Paternoster Square | 19 March 2025

Visit the panel with Frank Odendall: Europe, the US and the remaking of global liquidity patterns

Moderator: Andy Turvey, GLMX

Panelists:

- Frank Odendall, Eurex

- Bruce Bardon, iA Global Asset Management

- Paul Bellini, DNB Markets

- Antony Baldwin, LSEG Markets

ICMA Frankfurt

📍 Kap Europa Messe Frankfurt | 4-6 June 2025

Visit the panel with Frank Gast: The state and future prospect for the repo market

Moderator: Gareth Allen, Managing Director, Global Head Investment and Execution, Head of Repo Trading - Group Treasury, UBS

Panelists:

- Charlie Badran, Head of AXA Financing, AXA Investment Managers

- Amanda Butavand, Managing Director & Head of European Short Term Market Sales, Credit Agricole CIB

- Sabine Farhat, Head of Securities Finance Product Management, Murex

- Frank Gast, Managing Director, Member of the Management Board & Global Head of Repo Sales, Eurex Repo

- Michel Semaan, Global Head of LCH RepoClear, LSEG Post Trade

ISLA Madrid

📍 Hotel Puerta America | 17-19 June 2025

Volumes

| |||

|

Participants: 167