T7 Release 13.0

With T7 Release 13.0 the following enhancements have been introduced:

- Enhanced Drop Copy Service

- Basket TRF calendar roll strategy and early termination

- MiFID II/MiFIR order flagging requirements: Enhancements of the Short Code (SC) and Algo ID solution

- ISV and software registration process

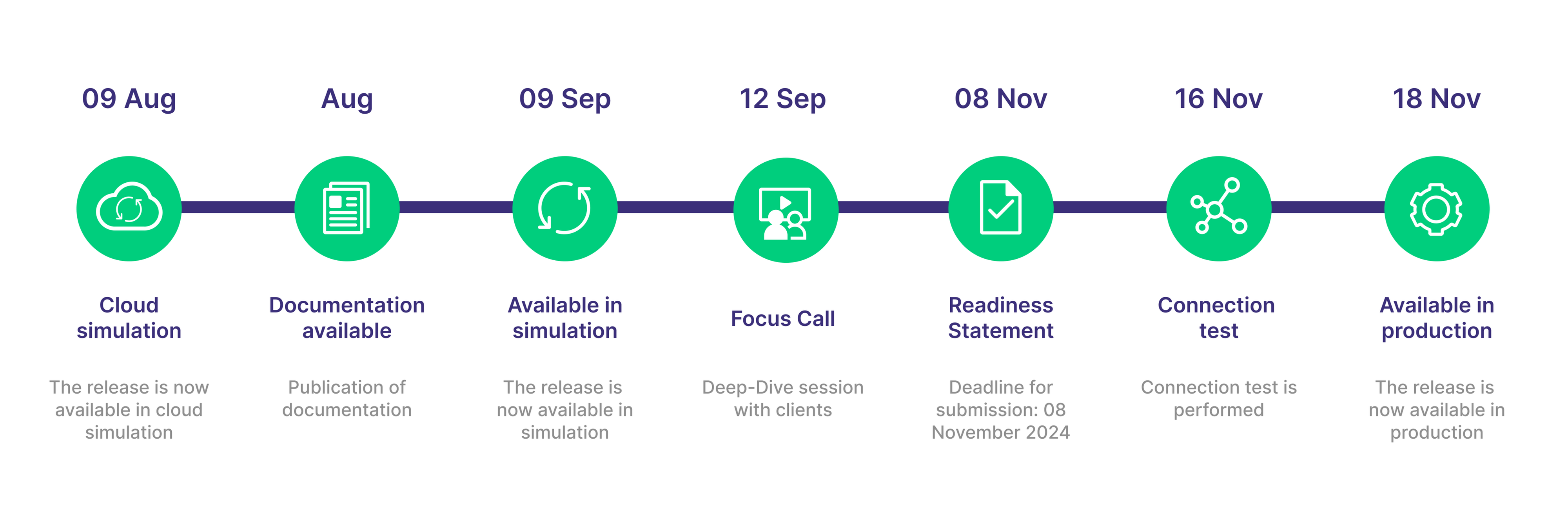

Simulation start: 09 September 2024

Production start: 18 November 2024

System Documentation

- T7 Release 13.0 - Final Functional Technical Release Notes Eurex, Version 2

Published 17 Oct 2024 - The release notes for T7 give an overview of the functional and technical enhancements and changes to be introduced. - T7 Release 13.0 - Functional Reference, Version 2

Published 17 Oct 2024 - This document provides a detailed insight into the functional concepts of the T7 trading architecture. - T7 Release 13.0 - Function and Interface Overview, Version 1

Published 26 Aug 2024 - The document provides an overview of T7. It describes the major functional and system features and provides a high-level description of the interface landscape. - T7_Release 13.0 - Cross System Traceability, Version 1

Published 26 Aug 2024 - This document contains detailed information on order, quote and trade traceability across trading and clearing systems focusing on the markets XEUR (Eurex Frankfurt) and XETR (Xetra Frankfurt).

Enhanced Trading Interface

- Release 13.0 Enhanced Trading Interface Manual, Version 3

Published 23 Sep 2024 - The document provides information relating to the T7 Enhanced Trading Interface (ETI) and contains a detailed description of the concepts and the messages used by the interface for both the Cash and Derivatives Markets. - T7 Release 13.0 Enhanced Trading Interface - Derivatives Message Reference, Version 3

Published 23 Sep 2024 - This document provides a reference to all message formats for the Enhanced Trading Interface derivatives markets. - T7 Release 13.0 Enhanced Trading Interface - Cash Message Reference, Version 3

Published 23 Sep 2024 - This document provides a reference to all message formats for the Enhanced Trading Interface cash markets. - T7 Release 13.0 Enhanced Trading Interface - XSD XML representation and layouts, Version 3

Published 23 Sep 2024 - The package contains the XML representation and the schema files for the Enhanced Trading Interface (ETI) for both the Cash and Derivatives Markets. - T7 Production Public Key for ETI password encryption [sequence no. 2]

Published 11 May 2024 - Public key for ETI session and user login with password encryption. - T7 Production Public Key for ETI password encryption [sequence no. 1]

Published 20 May 2023 - Public key for ETI session and user login with password encryption. - T7 Simulation Public Key for ETI password encryption [sequence no. 2]

Published 22 Mar 2024 - Public key for ETI session and user login with password encryption. - T7 Simulation Public Key for ETI password encryption [sequence no. 1]

Published 20 May 2023 - Public key for ETI session and user login with password encryption.

FIX LF

- T7 Release 13.0 FIX LF Interface - FIX LF Manual, Version 2

Published 7 Aug 2024 - This document provides a reference to all message formats for the Enhanced Trading Interface derivatives markets. - T7 Release 13.0 FIX LF Interface - Derivatives Message Reference, Version 2

Published 7 Aug 2024 - The purpose of this document is to provide all message formats for the derivatives markets part of the FIX LF interface. - T7 Release 13.0 FIX LF Interface - Cash Message Reference, Version 2

Published 7 Aug 2024 - The purpose of this document is to provide all message formats for the cash markets part of the FIX LF interface. - T7 Release 13.0 FIX LF XSD XML representation and layouts, Version 2

Published 7 Aug 2024 - The package contains the QuickFix Engine dictionaries (FIXLF44_Derivatives.xml, FIXLF44_Cash.xml) and message reference files including message and field descriptions (FIXLF_DerivativesExt.xml, FIXLF_CashExt.xml) for the T7 FIX LF interface per marketplace type.

- T7 Release 13.0 Market and Reference Data Interfaces Manual, Version 2

Published 4 Sep 2024 - The document provides information relating to the market and reference data interfaces (EMDI, MDI, RDI and RDF) and contains a detailed description of the concepts and messages used by the interfaces. - T7 Release 13.0 Market + Reference Data Interfaces XML FAST Templates - FIXML schema files, Version 2

Published 4 Sep 2024 - The package contains the XML FAST template files (FAST 1.1 and 1.2) and FIXML schema files for the T7 market and reference data interfaces (EMDI, MDI and RDI). - T7 Release 13.0 Enhanced Order Book Interface Manual, Version 2

Published 4 Sep 2024 - The document provides information relating to the T7 Enhanced Order Book Interface (EOBI) and contains a detailed description of the concepts and messages used by the interfaces. - T7 Release 13.0 Enhanced Order Book Interface XML Representation, Version 2

Published 4 Sep 2024 - The package contains the XML representation and the schema files for the T7 Enhanced Order Book Interface (EOBI). - T7 Release 13.0 - Extended Market Data Service Trade Prices, Settlement Prices and Open Interest Data Manual, Version 1

Published 26 Aug 2024 - The document provides information relating to the market and reference data interfaces (EMDI, MDI, RDI and RDF) and contains a detailed description of the concepts and messages used by the interfaces. - T7 Release 13.0 - Extended Market Data Service - XML FAST Templates - FIXML schema files, Version 1

Published 26 Aug 2024 - The package contains the XML FAST template files (FAST 1.1 and 1.2) and FIXML schema files for the T7 market and reference data interfaces (EMDI, MDI and RDI). - T7 Release 13.0 - Extended Market Data Service - Underlying Ticker - Manual, Version 1

Published 26 Aug 2024 - This document provides the information about the Underlying Ticker service for T7. - T7 Release 13.0 - Extended Market Data Service - Underlying Ticker Service - XML FAST Templates, Version 1

Published 26 Aug 2024 - This document provides the XML FAST templates for the Underlying Ticker service for T7. - T7 Release 13.0 - Eurex Market Signals Version 1

Published 26 Aug 2024 - The document contains the manual providing detailed information about the Eurex Market Signals. - T7 Release 13.0 - Eurex Market Signals - XML FAST Templates Version 1

Published 26 Aug 2024 - The package contains the XML representation and the schema files for Eurex Market Signals.

- T7 Release 13.0 Enhanced Drop Copy Interface - Manual, Version 1

Published 16 Dec 2024 - The T7 Enhanced Drop Copy Interface (EDCI) is a service for both Trading participants and Clearing members providing order information. The purpose of this manual is to provide participants with documentation of the current version of the interface, describing its main concepts. - T7 Release 13.0 Enhanced Drop Copy Interface Interface - Derivatives Message Reference, Version 1

Published 16 Dec 2024 - The purpose of this document is to provide all message formats for the derivatives market part of the Enhanced Drop Copy Interface. - T7 Release 13.0 Enhanced Drop Copy Interface Interface XSD & XML File, Version 1

Published 16 Dec 2024 - The package contains the XSD file for EDCI and the XML file for the derivates EDCI messages.

- T7 Release 13.0 Derivatives Markets Trader, Admin and Clearer GUI Manual, Version 4

Published 22 Jan2025 - This document provides information on the T7 Derivatives Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Derivatives Markets GUIs are described. - T7 Release 13.0 Cash Markets Trader, Admin and Clearer GUI Manual, Version 3

Published 4 Nov 2024 - This document provides information on the T7 Cash Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Cash Markets GUIs are described. - T7 Release 13.0 - Trader GUI, Admin GUI and Clearer GUI - Installation Manual, Version 1

Published 26 Aug 2024 - This document provides information on Deutsche Börse's T7 GUI solutions, the T7 Trader GUI, T7 Admin GUI and T7 Clearer GUI from a technical point of view. The document explains how to establish connection to Deutsche Börse's T7 with the GUI solutions. - T7 Release 13.0 - Derivatives Market Eurex - Participant and User Maintenance Manual, Version 1

Published 26 Aug 2024 - This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7. - T7 Release 13.0 - Cash Markets - Xetra and Börse Frankfurt: Participant and User Maintenance Manual, Version 1

Published 26 Aug 2024 - This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7 - T7 Derivatives Markets Gui What's New, Version 1

Published 12 Sep 2024 - This document provides compact information of the new GUI related features for the release. - T7 Cash Markets Gui What's New, Version 2

Published 12 Sep 2024 - This document provides compact information of the new GUI related features for the release.

- N7_-_Network_Access_Guide.v.2.5

Published 22 Jan 2025 - This document provides details on the network access options for T7 and Eurex Clearing's interfaces. It includes detailed technical background information, such as router equipment information and port numbers for the configuration of firewalls. - T7 Disaster Recovery Concept 2025 - Interface Configuration Details v.1.0

Published 3 Mar 2025 - This document provides an overview of Deutsche Börse’s disaster recovery concept for the T7 trading system. It contains the required technical background information as well as functional features and limitations to enable participants to continue trading in a DR situation. - T7 Market Data Report Derivatives 2024-08-05

Published 7 Aug 2024 - This file contains for one specific date (Frankfurt time) the number of packets per multicast address and port combination enhanced with the stream and market information. Please note that the number of packets varies per day and the “From” and “To” columns contain the first and last minute where data was received on that day for the respective combination. - T7 Market Data Report Cash 2024-08-05

Published 7 Aug 2024 - This file contains for one specific date (Frankfurt time) the number of packets per multicast address and port combination enhanced with the stream and market information. Please note that the number of packets varies per day and the “From” and “To” columns contain the first and last minute where data was received on that day for the respective combination. - T7 Market Data Report Derivatives 2024-03-25

Published 27 Mar 2024 - This file contains for one specific date (Frankfurt time) the number of packets per multicast address and port combination enhanced with the stream and market information. Please note that the number of packets varies per day and the “From” and “To” columns contain the first and last minute where data was received on that day for the respective combination. - T7 Market Data Report Cash 2024-03-25

Published 27 Mar 2024 - This file contains for one specific date (Frankfurt time) the number of packets per multicast address and port combination enhanced with the stream and market information. Please note that the number of packets varies per day and the “From” and “To” columns contain the first and last minute where data was received on that day for the respective combination.

- T7_R.13.0_-_XML_Report_Reference_Manual_Version_3

Published 18 Dec 2024 - This document describes all reports based on T7 trading data for both the cash and derivatives markets. - T7_R.13.0_--_XML_Report_Modification_Notes_Version_3

Published 18 Dec 2024 - This document provides an overview of the enhancements and changes to the T7 XML Reports as compared to the previous version. - T7_R.13.0_-_XML_Reports_XML_Schema_Files_Version_3

Published 18 Dec 2024 - This package contains the reports xsd files for T7 cash markets and derivatives markets reports. - Common Report & Upload Engine User Guide - Version August 2024

Published 26 Aug 2024 - The Common Report Engine allows the centralised provisioning of reports and the Common Upload Engine the upload of files. The manual contains everything from access information to the CRE & CUE and report/file naming conventions for CRE.

- T7 Release 13.0 - Participant Simulation Guide, Version 1

Published 26 Aug 2024 - This document describes the timeline, new and changed features as well as the simulation focus days for this T7 release. Please use this document to plan and prepare your T7 Release simulation participation. - Known Limitations for T7 Release 13.0 Simulation, Version 7

Published 23 Oct 2024 - This document lists the current known limitations for the T7 Release simulation. - T7 Release 13.0 - Trading Parameters (Simulation)

Published 9 Sep 2024 - This file contains the trading parameters for the T7 Release 13.0 simulation environment.

-

T7 Release 13.0 - Focus Call Presentation

Publication date: 13 Sep 2024

- T7 Incident Handling Guide v.5.6

Published 26 Aug 2024 - This document provides a detailed description of the reaction of Deutsche Börse's T7 trading system to technical incidents and provides best practices for handling them. In addition the document provides references to the respective focus days in the T7 simulation environment which are intended to simulate such incidents. - T7_-_Known_Limitations_Prod_v1

This document lists the current known limitations for T7 Release 13.0.

Circulars

Readiness Videos

Readiness Statement

All Trading Participants are asked to submit the Readiness Statement for T7 Release 13.0 by Friday, 08 November 2024 latest.

The online Readiness Statement is here available: Readiness Statement. Please enter your dedicated Eurex PIN in the online questionnaire. The PIN is available for the Central Coordinator in the Member Section under the following path: My Profile > PIN.

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Enhanced Drop Copy Service | Eurex launched a new Enhanced Drop Copy (EDC) interface to provide a comprehensive overview of all orders, including lean orders. The service aims at Trading Members who want to improve their pre-trade risk monitoring or obtain a complete overview of their order inventory. Consequently, Eurex extended the T7 system landscape with a new dedicated EDC gateway to connect to the interface. | Trading Members that would like to make use of the new EDC service need to adapt to these changes and perform sufficient testing. |

Basket TRF calendar roll strategy and early termination | Eurex introduced an advanced feature in the T7 Trader GUI and ETI to roll Basket Total Return Futures (BTRF) in a single basket operation. Additionally, Eurex enables the counterparties of a BTRF to mark a basket for early termination. | Trading Members need to adapt to changes related to the advanced feature and perform sufficient testing. |

MiFID II/MiFIR order flagging requirements: Enhancements of the Short Code (SC) and Algo ID solution | Report enhancements have been introduced to provide Trading Participants with more frequent feedback and assist in resolving issues with missing SCs and Algo IDs, upload errors, and the registration and maintenance of SCs and Algo IDs. More information will be available on a dedicated Support page soon. | All Trading Members need to adapt to these changes and perform sufficient testing. |

ISV and Software Registration process | Eurex introduced a new registration process for Independent Software Vendors (ISVs) and third-party software, as well as in-house software developed by Trading Participants, used to connect ETI and FIX LF sessions. Trading Participants and ISVs will need to enhance software usage details in the Member Section on a session level. The project will be implemented in stages, with more information provided on a dedicated support page soon. | All Trading Members and Independent Software Vendors (ISVs) need to adapt to these changes and complete the new process. |

Eurex plans to perform a system clean-up in C7 GUI. All accounts that have not been used for more than two years will be deleted, except some cases. For more information, please check the C7 Release 11.0 Support page.

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Contacts

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!