May 12, 2025

Eurex

Focus on VSTOXX® Derivatives | April 2025 recap

- European markets were mixed for the month, with the EURO STOXX 50® down 1.68%, the STOXX® 600 down 1.21%, and the DAX® up 1.50%

- While the indexes were mixed, implied volatility was flat to lower across all equity markets

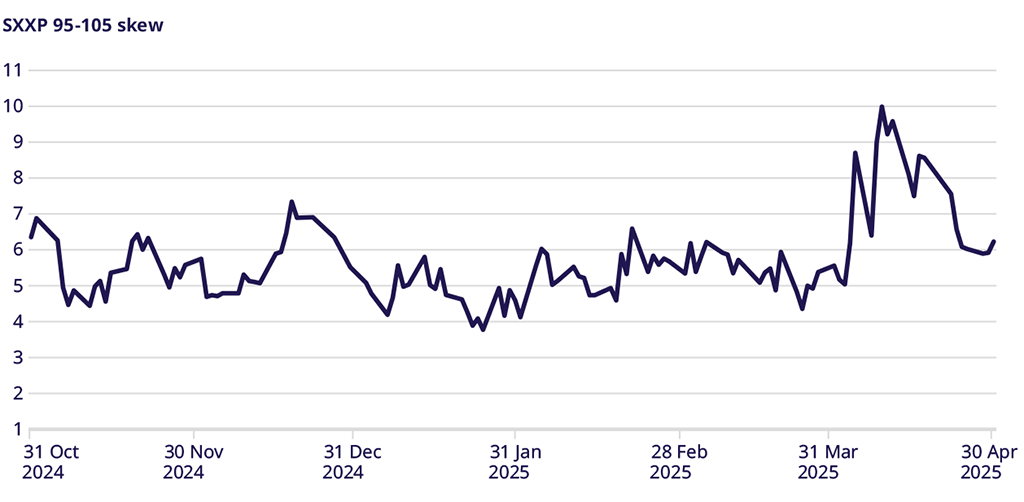

- Skew moved sharply in favor of the downside strikes (puts) early in April and reverted somewhat by the end of the month but was still higher for the month

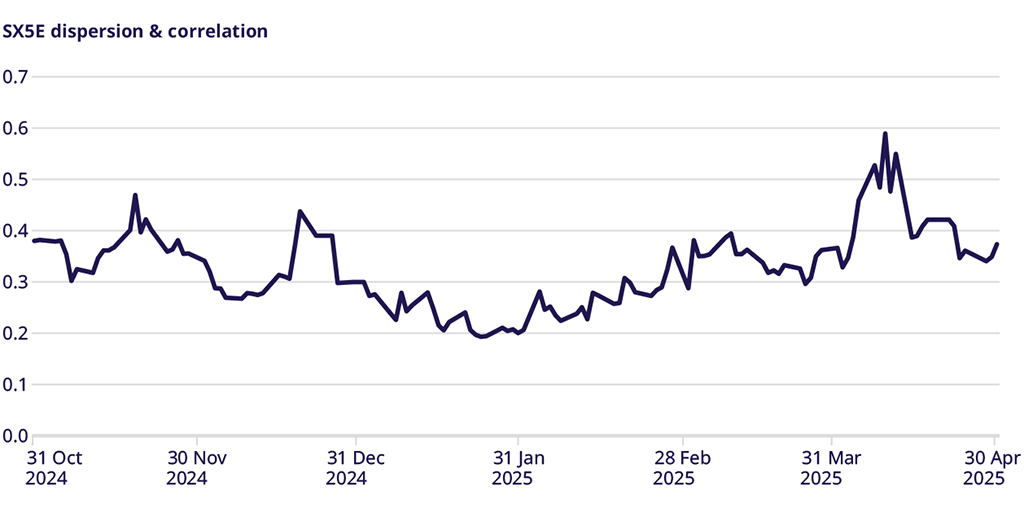

- Similarly, the implied correlation moved sharply higher in the first week of the month before settling but still higher by the end of the month

Equity Index Volatility

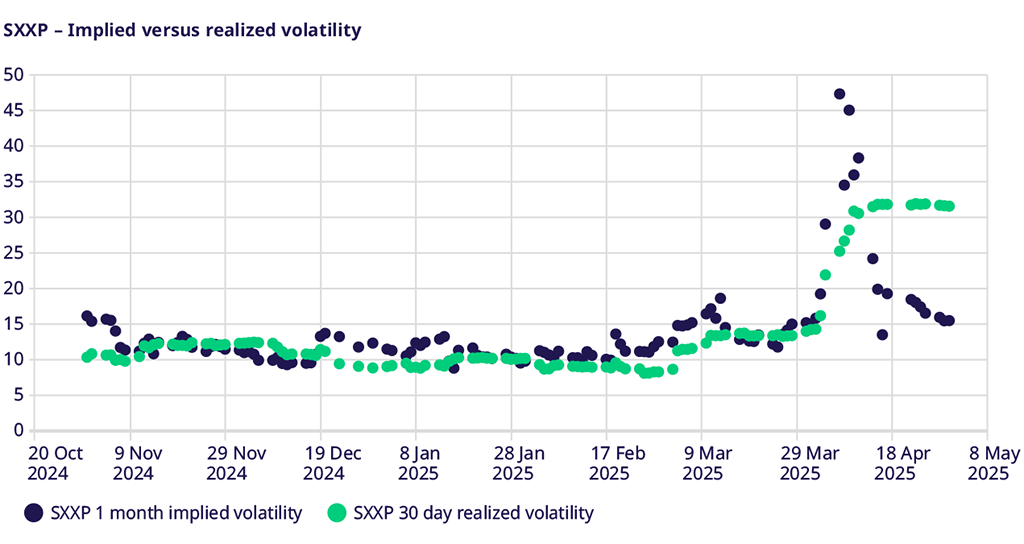

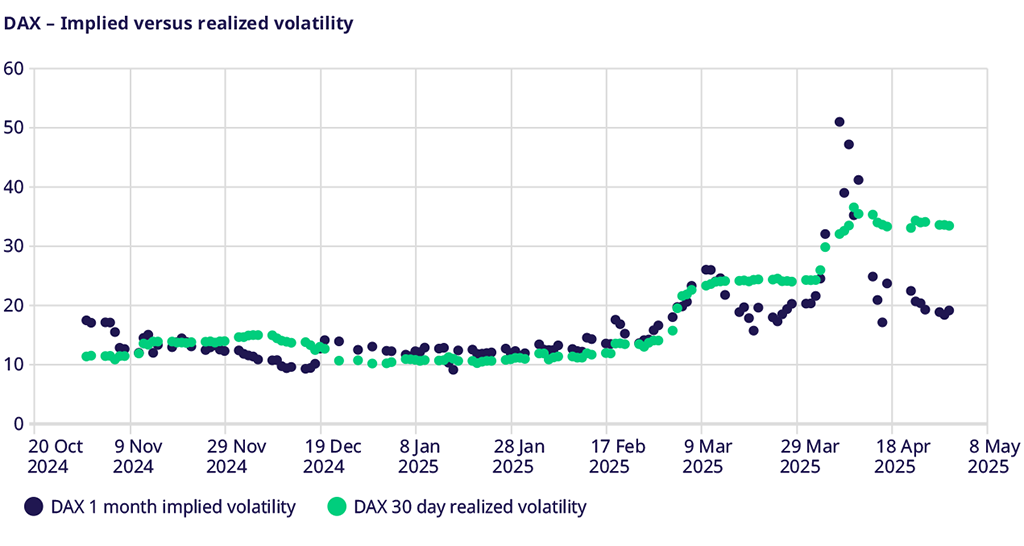

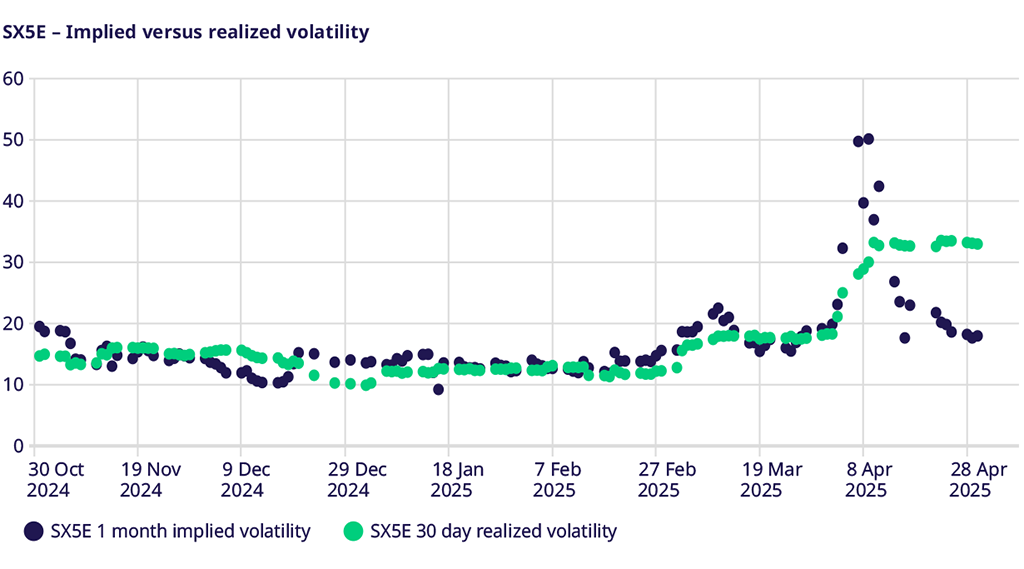

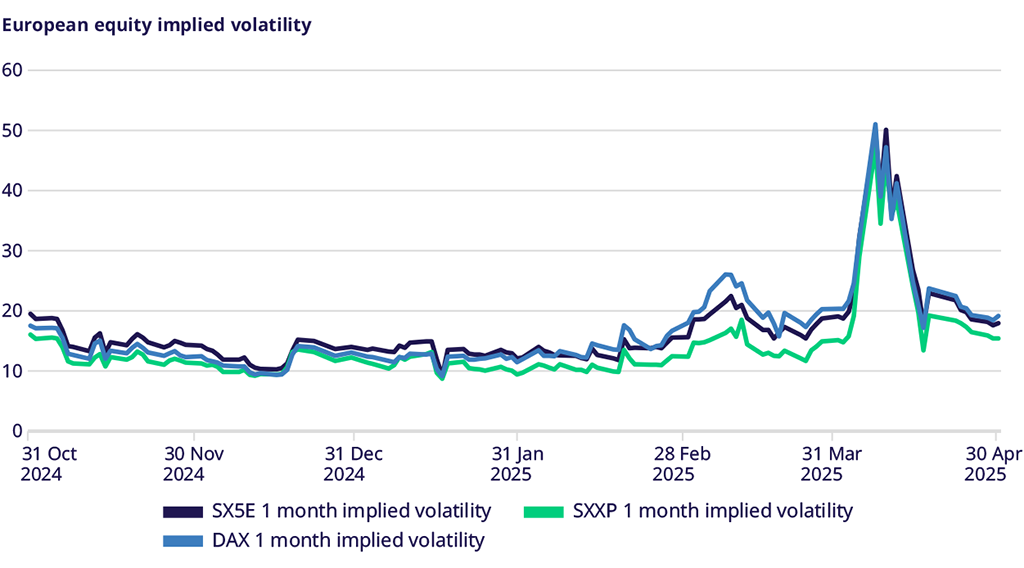

Although the outcome was varied within equity indexes, a consistent pattern emerged across all markets: a sharp downward movement in stocks at the month's outset, followed by a normalization by month’s end. Therefore, it's no surprise that equity volatility remained elevated throughout the month, though notably lower than the peak uncertainty experienced during the first week of April. SX5E implied volatility hit a peak above 50% before settling back to 18%. The DAX also peaked above 50% at 51% but closed just above 19%. Finally, SXXP moved to 45% but settled at 15.4%.

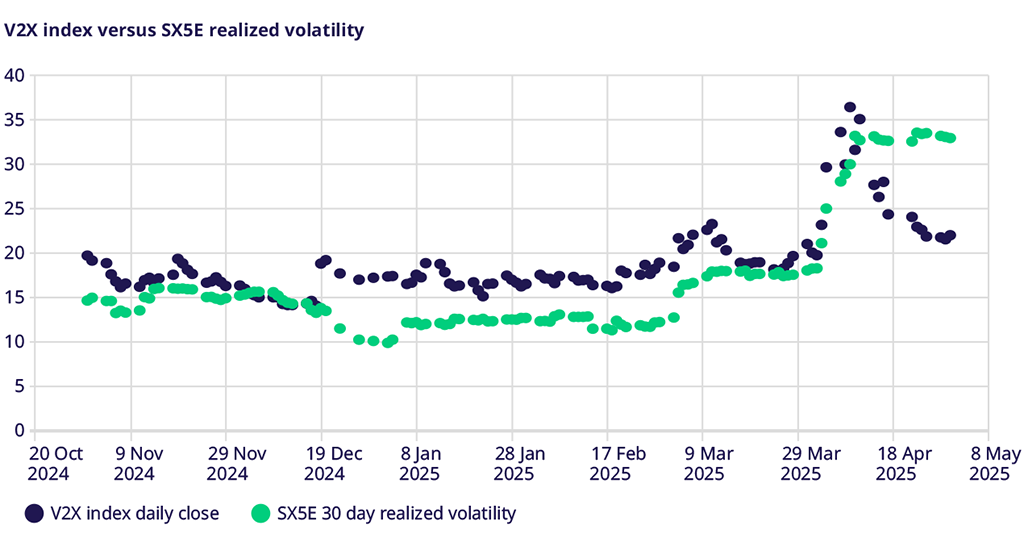

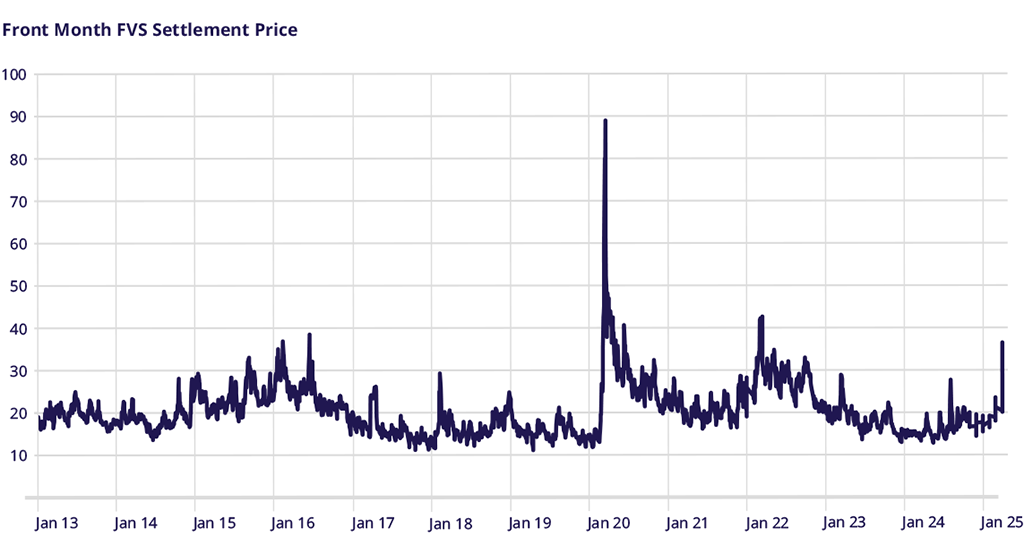

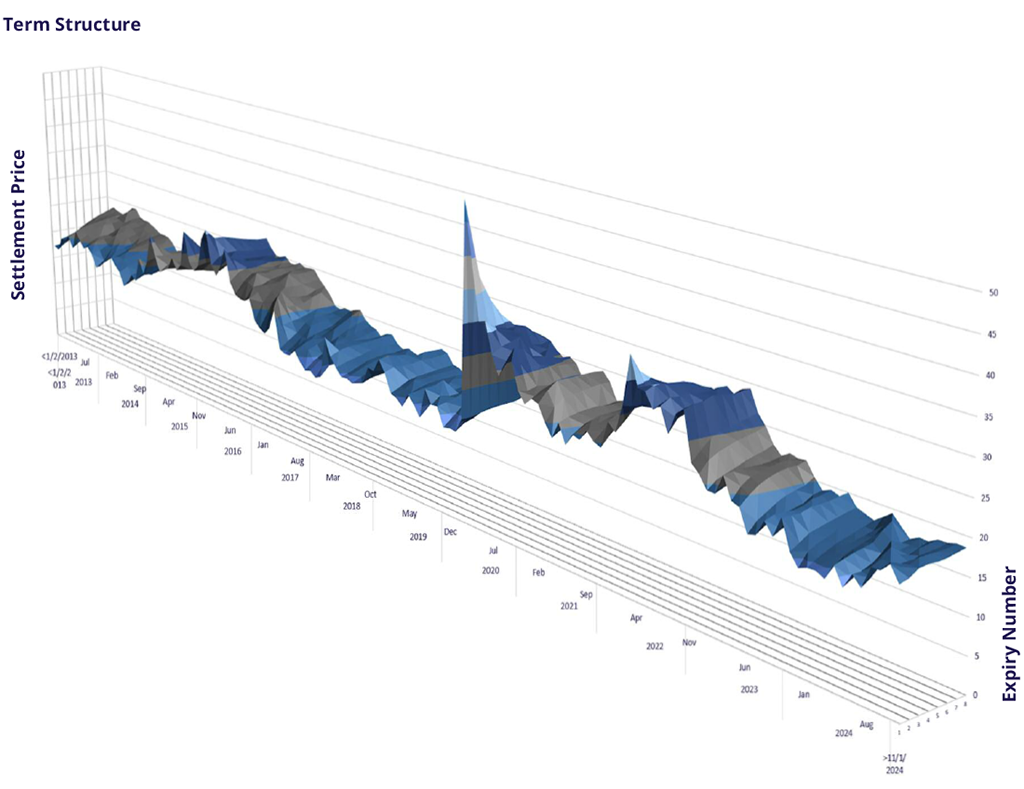

VSTOXX Index performance

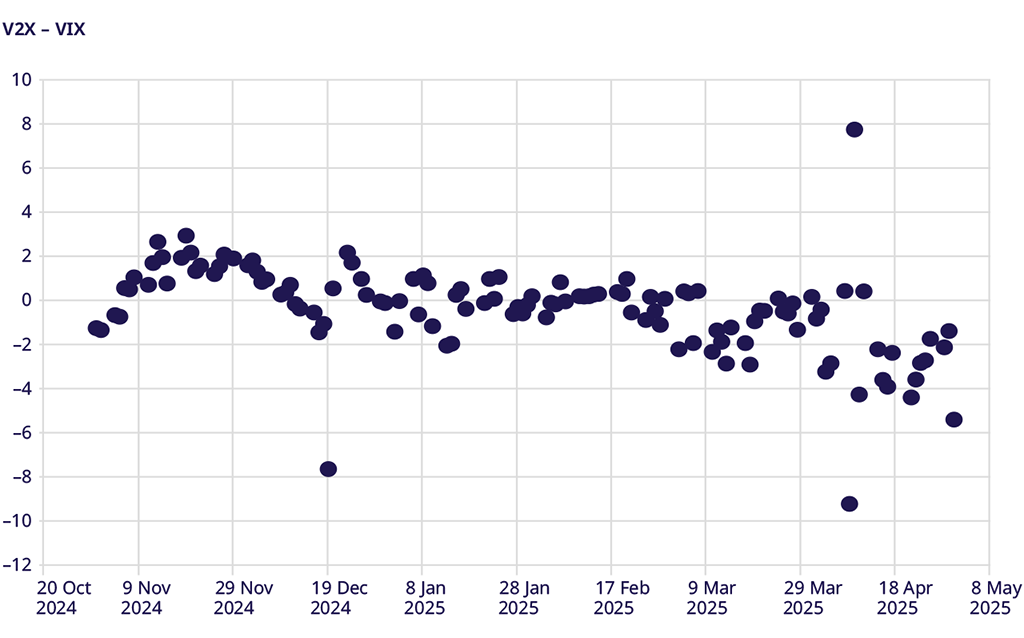

The V2X front-month futures also hit levels above 36 and settled at 22 for the month. The move at the start of the month was sharper than the realized volatility of the SX5E index. Still, it ended the month well below, trailing realized volatility, as traders presumably predicted further normalization ahead. The spread of V2X and VIX futures was highly volatile, trading from a discount of nine vols to a premium of almost eight vols. At the end of April, V2X stood five vols below the VIX, having remained flat at the end of March, with uncertainty being priced more into US indexes.

STOXX Europe 600 Index Skew

The skew started the month at 5.5 vols but reached a high of nearly 10 vol spread in early April. As the month concluded, the spread reverted to just over six vols, which is the average for the last six months.

Correlation

A round-trip similar to other markets happened in implied correlation. Starting the month at 36.6%, implied correlation peaked at 59%, close to crisis levels, before settling at the end of the month just over 37%.

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

VSTOXX 101: Understanding Europe’s Volatility Benchmark

Discover the latest STOXX whitepaper today to learn more about the VSTOXX® core methodology, historical performance analysis, and more.

For more information, please visit the website or contact: