Listing process Open Market

Going Public Open Market

Overview

Placement

Briefly, you have to do the following

- Preparation of an offer for sale

- Offering price determination

- Stock placement

- Allocation of stock to investors

General

The placement in the context of an IPO is the execution of a first public offer to sell securities on the capital market. The placement is therefore one of the most important tasks of the issuing bank and is decisive for the success of the IPO.

The objective of the issuer is to sell all the shares to be placed at an attractive price for the issuer and the investors.

Before the actual placement process begins, an agreement is made between the issuer and the (underwriting) consortium regarding the underwriting of the new securities for the purpose of sale (underwriting agreement). This is followed by the offer phase.

At the end of the placement process, the securities offered are allocated to the future investors. This is followed by the so-called stabilisation phase, in which the issuing banks can intervene in a stabilising manner in market pricing in order to compensate for fluctuations that may occur as a result of the issue.

In case of a non-public placement, this is usually a so-called private placement. Here, the new shares created by the capital increase are only offered for sale to a limited group of predominantly institutional investors, cf. section 1 para. 4 EU-ProspektVO.

The Public Offering

In an IPO, the shares are publicly advertised and the company is presented to institutional investors in roadshows, among other events. In order to provide investors with the necessary information for their investment decisions, the company publishes a securities prospectus that has previously been reviewed and approved by BaFin.

The public subscription and sale offer is aimed both at institutional investors and the general public (in particular private investors) and, in addition to better sales opportunities, has the advantage that it appeals to a broad investor audience and thus attracts greater attention.

Ultimately, this also results in a sufficient free float of the securities, which is at the same time a prerequisite for the inclusion of the securities in Scale, cf. § 17 para. 1 lit. e) GTC Open Market. Without sufficient diversification at the time of inclusion of the shares or certificates representing shares, functioning stock exchange trading cannot be guaranteed.

Determination of the Offering Price

Price fixing is one of the most important steps in the issuing of securities, because the price determines the amount of the issue proceeds and thus also the success of the issue. On the one hand, it is possible to determine the issue price as a fixed price before the start of the offer (so-called fixed-price procedure); on the other hand, the issue price can be determined openly within the framework of the offer procedure on the basis of supply and demand (so-called tender procedure and bookbuilding procedure).

The starting point for determining the issue price is a comprehensive company analysis and valuation (due diligence) carried out in advance, taking into account the stock market valuation of comparable companies (peer group) and the general market situation. The price or a price range for the share is determined on the basis of the market price for shares in the company determined in this way ("fair value"). The selling price should take into account the capital requirements of the issuer on the one hand, but should also include potential price increases on the other in order to make the investment in the security attractive for investors.

Depending on the company's focus on the issue, the company chooses one of the following methods to determine the issue price:

- fixed-price procedure

- tender procedure

- book building procedure

In the fixed-price procedure, the shares are placed at a fixed price, i.e. the Company and the lead underwriter (possibly together with the selling existing shareholders) agree on a fixed price before publication of an offer to sell at which the shares in the issue are to be offered and sold. This pricing method has the disadvantage that the issuer and the issuing banks can no longer react to a changing market environment during the offer. If market participants rate the price as too high, the risk of not being able to place the securities completely or having to adjust the price downwards increases, with the result that the proceeds from the issue would fall short of expectations and the success of the issue would therefore be jeopardised.

When an issue of securities is placed using the tender or auction procedure, no specific selling price is specified. The offer only contains information on the security's features, the issue volume and a minimum price as the lower limit. Interested investors may submit a purchase offer at the minimum price or a higher price within the subscription period. At the end of the offer period, the buyers acquire a security at a unit price, which is calculated, for example, as the average value of all bids submitted (so-called "Dutch procedure") or at the purchase price individually indicated in the bid submitted (so-called "American procedure"). In this pricing method, the selling price for the securities is being determined by supply and demand. The issue proceeds and thus the success of the public offer are ultimately in the hands of the market. For this reason, investors in this pricing method require sufficient knowledge of the capital market and the current market situation in order to be able to submit appropriate bids for the securities offered.

Finally, the book building procedure combines the advantages of the fixed-price procedure with those of the auction procedure. During these past years, it has developed to become the most favoured price determination instrument especially for stock issue and, thus, will be explained in more detail below.

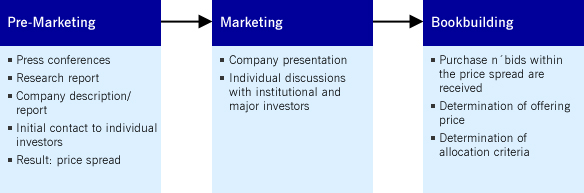

The book building procedure is divided into different stages:

In the classic bookbuilding procedure, the issuer, the lead manager and/or the existing shareholders jointly determine a price range before the start of the offer period. This is determined in advance on the basis of the due diligence carried out in conjunction with a targeted investor survey by the issuing consortium. The underwriting syndicate investigates the interest of potential investors in the shares, for example by requesting non-binding purchase offers. Before the actual offer phase begins, a price range is determined which is published together with all further information on the securities offered.

Parallel to the discussions with investors to determine the price range, the issuer, accompanied by the issuing consortium, presents itself at various financial centres in order to give interested investors the opportunity to obtain specific information about the securities and the issuer. The aim of these so-called roadshows is to attract investors through professional marketing, individual contact with specific investor groups and the creation of transparency.

At the start of the subscription period, all incoming offers within the specified price range are being recorded in a central order book. At the end of this period, the issue price is determined on the basis of the bids received. Any purchase offers submitted that are below this issue price are not taken into account in the allocation of shares. Investors who have bid a higher price than the final issue price acquire the security at the issue price. If there are purchase offers for a larger number of shares than issued by the issuer, allocation criteria are set. Thus, with this type of price determination, the company has the opportunity, when deciding on the selling price, to focus on the type and distribution of future shareholders.

Decoupled bookbuilding" has developed as a variant of the classic bookbuilding procedure. With this method, the subscription period is shortened to a few days and the price range is only announced shortly before the order book is opened. At this point, the roadshow is generally completed. The marketing of the securities is thus uncoupled from the process of determining the price range and the issue price. This reduces the risk of public opinion forming, for example, exerting pressure on the issue price to the shorter subscription period phase.

The Allocation

The submission of a purchase offer or an order to subscribe for shares does not entitle the holder to purchase securities per se or to purchase them at a fixed price. A so-called allotment is required. The issuer and the underwriter decide whether and how many shares an investor will receive on the basis of his offer. The planned shareholder structure is the central criterion for the allocation decision. Here, for example, considerations are taken into account as to whether a broader distribution of the shares is desired, whether private or institutional investors are sought more strongly as shareholders, or whether an international participation is desired.

In the event of an oversubscription of the securities, i.e. if there are purchase offers for a higher number of shares than actually issued by the issuer, the company and the (lead) issuing bank determine the allocation criteria according to which the shares are allocated. The investors may then only receive a portion of the desired securities on the basis of a calculated quota resulting from the allocation criteria.

Some issuers use the opportunity to reserve a portion of the publicly offered securities for employees of the Company or of affiliated and partner companies and to allocate shares subscribed for as part of a Friends & Family programme to these investor groups.

As a rule, the allocation takes place on the evening of the last day of the placement period immediately after the closing (settlement of the placement) and is published on the same day via electronic media.

The Placement Risk

In order to transfer all or part of the placement risk to the underwriting syndicate in accordance with the interests and risk appetite of the issuer, an underwriting agreement is regularly concluded between the issuer and the individual underwriters prior to the commencement of the public offering. A differentiated distribution of risk is possible here:

If the parties choose the form of an underwriting syndicate, the syndicate banks acquire the intended number of shares issued (syndicate quota) at a fixed price and then place them on the capital market for their own account. The risk of the placement (sales and price risk) lies with the issuing banks. After completion of the offer and allocation procedure, any residual holdings not placed will initially remain in the ownership of the underwriters.

Conversely, the issuing banks act as a pure issuing consortium. The issuing banks act as commission agents for the initial placement of the securities. If necessary, they provide the company with an issue loan to pre-finance the issue of securities and place the securities on behalf of and for the account of the issuer. In this case, the entire placement risk lies with the issuer both in terms of the price of the shares offered and in terms of the number of shares sold.

In practice, a combination of both of the above variants has developed - the so-called single consortium. The assumption of the securities by the issuing banks is linked to the intention to leave the execution and placement risk to the stock exchange candidate to an appropriate extent. This can be achieved, for example, by fixing the acquisition or takeover date at a date shortly before the end of the subscription period or by setting the acquisition or takeover price at the statutory minimum. When selecting a single consortium, the company has the option of deciding on the final size of the capital increase and the timing of the issue. In this context, over-allotment options or the agreement of cancellation clauses for certain cases also serve to spread risk evenly.

The Private Placement

In a private placement, the newly created shares of an issuer are not offered publicly, but only to a select group of investors. Together with the issuer, the banks target potential investors with whom they maintain regular intensive contact. As a rule, these are institutional investors.

This form of placement, which often saves time and money, is suitable for smaller domestic issues, for example. A particular advantage here is that the issuer is exempt from the obligation to publish a securities prospectus in accordance with the provisions of the German Securities Prospectus Act (WpPG) in the case of an offer addressed to fewer than 150 unqualified investors in any country of the European Economic Area, cf. section 1 para. 4 lit. b) EU-ProspektVO.

Contact Person

IPO & Growth Financing Hotline

E-Mail: issuerservices@deutsche-boerse.com

Telephone: +49-(0) 69-2 11-1 88 88

Fax: +49-(0) 69-2 11-1 43 33