Listing process Regulated Market

Listing process Regulated Market General Standard

Overview

Selection of IPO-experts / IPO-conception

Briefly, you have to do the following:

Select the IPO-experts who usually consist of

- an IPO-advisor,

- an issuing bank and a banking syndicate,

- certified accountants and lawyers as well as

- a PR-agency.

At the beginning of the IPO-process you work out an IPO-conception jointly with the IPO-counsel and/or the issuing bank, which serves as schedule leading to the ultimate object “IPO“.

General

An initial public offering (IPO) is a complex process requiring both practical as well as special technical knowledge. It is divided into a preparation stage, a planning stage and an actual process stage. On its way to going public, the company needs qualified partners during the different processes that render assistance in various ways. Therefore, for its IPO the company will seek the assistance of a team consisting of IPO-advisor, an issuing bank and further syndicate banks, certified accountants and lawyers as well as a PR-agency, if need be. In cooperation with part of their IPO-underwriters the company will prepare a project plan covering the complete IPO-performance, which determinates and structures its contents and arranges the time schedule. This IPO-conception forms the base for the cooperation of all persons involved in the project.

IPO-experts

Due to the complexity of an IPO, counselling in various areas performed by experts from different functional directions is required. As a rule, these are:

IPO-advisor

Often the IPO-advisor is the first contact point for the company planning to go public. Depending on the agreement concluded with the company, the IPO-advisor’s activities may be limited to a kick-off counselling or may cover the complete process. The IPO-counsel’s position is that of an independent counsel. In this function, the IPO-advisor might be in conflict with the issuing bank, for one, due to a possible interference of their areas of activity and, for another, due to the fact that the IPO-advisor is under no obligation towards the cooperating banks and can position the company in relation to the syndicate banks. In many cases it will be the IPO-advisor who takes over the management for the preparations along the way to going public and who assumes project management and coordination.

Above all, the possible fields of activity of an IPO-advisor are the following:

- review if the company meets the requirements for going public,

- review of the company strategy, the corporate planning and the management processes,

- assistance with compiling the company’s equity story displaying key skills, success factors and perspectives of the company,

- preparation of a fact book as well as a management presentation,

- preparation and assistance of the company in selecting the underwriting banks or other capital market experts (so-called “beauty contest“),

- project management and coordination of the cooperation between all the IPO-underwriters and the company and

- development of a first IPO-conception with benchmarks of the IPO-plans.

In addition, the IPO-advisor may support the company, if need be, even after the IPO in the course of public and investor relations activities.

Issuing bank and banking syndicate

Generally an IPO will be accompanied by a banking syndicate, i. e a consortium of several banks and/or financial services providers with one of the banks assuming the function of the syndicate manager. The leading issuing bank as well as the other underwriting syndicate members often are selected by means of a so-called “beauty contest“. The company provides several banks of its choice with information on the company, for instance in form of a fact book and a description of the company’s personal equity story, and invites the banks to apply for syndicate membership or for the syndicate manager position for the IPO in question. The banks and financial services providers will use the information on the company to gain a first evaluation of the possible success of an IPO with this company.

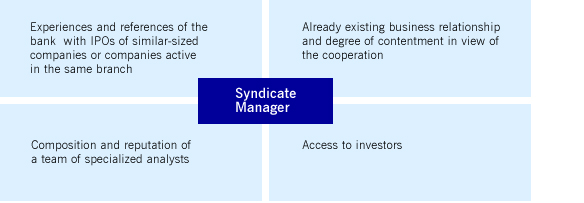

The company’s decision for a certain candidate as syndicate manager is of great importance and gives direction to the further success of the IPO. Therefore, the size of the institute should not bet he only criterion, but the company should consider in its selection also other matters which are listed in exemplary manner here.

In practice, the selection of the leading issuing bank and the composition of the banking syndicate will be directed to the objective of addressing a preferably wide-spread investor circle and to achieve an optimal offering price for the company’s stock.

The core functions of the issuing bank belong to the actual process stage. During this stage the responsibility of the syndicate manager reaches from the preparation of a detailed time schedule covering the complete IPO-process and the care for adherence to this schedule, to the performance of a thorough evaluation of the company (due diligence), to the company’s positioning on the capital market by means of the equity story up to the successful marketing and placement of the stock offered. Simultaneously, the issuing bank is involved in the preparation of the securities prospectus and leads the company through the subsequent stock market listing process from application submittal to the first price fixing.

In short, the syndicate manager’s functions, above all, are the following:

- review if the company meets the requirements for going public

- performance of due diligence and company evaluation

- preparation of a thorough IPO-conception including a detailed time schedule

- preparation of research and analysts’ presentations

- cooperation in the preparation of the securities prospectus

- marketing and placement of the IPO

- assistance during the complete process of admitting the securities for listing

- support of the issuer after the IPO.

For performing all of its functions the issuing bank relies on the company’s close and trusting cooperation.

Legal counselling

Lawyers may be involved at various times in the IPO-process. During preparation stage, the company might need to undergo restructuring measures under company law in order to meet the requirements for going public. In such a case, the supporting lawyers will assist the company, for example, with changing its legal form of organization to a joint-stock company or with modifications of its existing articles of association.

During the actual process stage, the preparation and performance of a legal due diligence is among the lawyers’ core tasks in the course of an IPO. The legal due diligence serves the purpose of checking the complete legal circumstances of the company and to discover and evaluate, as thoroughly as possible, any and all legal risks resulting from the issuer’s legal and business relationships. In this context, pending legal disputes will also be reviewed.

Finally, experienced lawyers will generally be involved in the preparation of the securities prospectus. Thus the company can safeguard that the contents of the prospectus will comply with all requirements set forth in the Regulation (EU) 2017/1129. After preparation of the prospectus, the lawyers will also assist the company during the approval procedure at the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) [German Federal Agency for Financial Market Supervision] and support the company at implementing the necessary prospectus supplements and corrections. After performing the due diligence and preparing the prospectus, the lawyers, if need be, will confirm to the syndicate manager or other parties involved in the process by means of a legal opinion, that the prospectus correctly and completely displays the legally relevant topics.

Certified accountant

Depending on the trading segment and transparency standard aspired, there are different requirements regarding the accounting standard of the candidate for flotation. Therefore, it might be necessary to involve the certified accountant into the IPO-process at an early stage already. In case of a public offering of securities the accountant will assist the company, for instance, already during the planning and preparation stage with the conversion form national accounting to IFRS-accounting required for Annual Consolidated Report or with reorganization measures performed by the company in advance, insofar as the preparation of financial information is necessary.

Further on, the certified accountant performs a thorough financial due diligence, in the course of which the company’s economic development so far as well as the economic development it intends to take in the future come under critical review. This review and the definition of chances and risks are entered in form of secured financial information and risk notices into the securities prospectus. Depending on the trading segment selected and the related transparency standard, the IPO requires the financial statements of preceding business years to be reviewed and provided with the auditor’s certificate and included in the securities prospectus.

Moreover, the certified accountant confirms, by means of a comfort letter towards the issuing bank the financial figures and financial statements contained in the prospectus. This comfort letter also serves as documentation of the individual review services performed by the accountant.

PR-agency

The public relations counsel (PR-counsel) manages in close collaboration with the candidate for floatation and the syndicate manager the communication processes with the important external target groups as well as the business and financial press media . An IPO centres the company into the focus of the capital market. As a result extensive requirements regarding the communication with investors, analysts and other participants of the capital market have to be met. The communication activities aim to increase the company’s awareness level on the capital market, to present the business activities into the context of market and competition and to position convincing arguments for a share investment. In doing so, the PR-counsel, in coordination with the company and the issuing bank, assumes the following functions:

- development of a communication strategy,

- participation in the development of an Equity Story

- preparation of a presentation for the road show,

- assistance of the company in press releases and ad hoc disclosures regarding the IPO,

- individual preparation of the management for appointments with media and investors,

- organization of an IPO-press conference,

- conception and implementation of a company’s investor relation-website,

- preparation of the company regarding an obligatory communication and the investor relationship work after floatation.

The PR-counsels offer also further services. For instance, they often support the company in the active media relations work as well as the coordination of management interviews with journalists, up to the complete organization of IPO marketing campaigns. Some PR-counsels offer the company’s public or investor relations services after the IPO has been concluded.

Deutsche Börse Capital Market Partner

For selecting the adequate IPO-underwriters, Deutsche Börse AG offers a network of experienced capital market experts, who can be recognized as Deutsche Börse Capital Market Partner. On the websites of Deutsche Börse AG you will find an up-to-date list of all Deutsche Börse Capital Market Partner, that are active in connection with admissions to the Regulated Market.

IPO-conception

The IPO-underwriters in their various responsibilities jointly develop a stock market listing conception which will be prepared in detail and set up in form of an IPO-conception. In this IPO-project plan all necessary processes and process steps are determined regarding both their contents and their timely sequence.

The IPO-conception means the compilation of all steps required for the IPO, individually adapted to the respective candidate for floating.

In the planning stage, the company in cooperation with the IPO-counsel and/or the issuing bank decides on basic conditions for the IPO, like the market segment targeted for the IPO, the transparency standard aspired, the issuing total volume, the stock market and, if need be, the class of stock. During preparation stage, the company’s equity story, financial requirements, application of funds, intended replacements, investor target group, stock market segment as well as employee profit-sharing schemes are recorded in the IPO-conception.

In short, the IPO-strategy contains in any case:

- a time schedule where the important steps of the IPO-process are set forth,

- the market segment and transparency standard fitting the company’s needs,

- an IPO-strategy to be presented to the capital market,

- the class of stock,

- the compilation of the banking syndicate,

- the course of events of the public offering or private placement,

- the investors circle to be addressed,

- the intended issuing total volume,

- the lock-up obligations (ban on sale affecting shareholders) and

- the intended date for the start of listing.

Some of the aforementioned topics will be explained below.

Time schedule

The IPO of a company, from the decision to go public up to the first price fixing, will take, depending upon how well the company meets the requirements for going public and how attractive it is for the investors, a time span of six to twelve months. The time schedule reflects the timely sequence of activities during the actual process stage. The individual process steps, however, will not necessarily happen one after the other, but may be performed partly simultaneously and may intertwine with each other.

A significant matter of the time schedule is that it allows for adequate time frames for the due diligence, for preparation and approval of the securities prospectus, for the preparation of a research study as well as for the pre-marketing, the road show and the determination of the offering price and, finally, for the admission procedure.

IPO-strategy

In order to achieve the objectives set forth in the IPO-conception, the company will discuss with its IPO-underwriters which strategies would lead to the most successful performance of the placement or the going public, respectively. Among these is the determination of the issuing volume and the investor target group to focus on. The procedure and the correct contents have to be fixed in detail and a convincing equity story has to be created displaying the company’s history as well as the chances for success the future holds for the company and its market environment. In order to provide evidence for the company history and its business prospects, the relevant financial figures are significantly important. The conclusive explanation of the application of funds raised through the IPO, e. g. for financing further growth, serves the purpose of a positive evaluation of the company as profitable financial investment. However, in the course of developing an IPO-strategy measures like replacements and lock-up agreements with existing shareholders after the IPO may be considered when deciding on the way to proceed.

Due diligence

The due diligence is a thorough review and analysis of the company, above all, in view of its economic, legal, tax-related and financial circumstances. In the course of an IPO, generally a financial, a legal and a tax due diligence will be performed by the underwriters involved und by authorized external service providers in their respective field of expertise. An additional market due diligence analyses the company’s position in its market environment as well as its chances for growth. As can be seen, further basic conditions, too, like the well-functioning organization and communication in a company, but also its technical equipment and production processes will be included by interested investors into their investment decision; therefore, in these areas a due diligence might also be performed sometimes.

The financial due diligence analyses the past and present property, financial and profit situation of the company. This serve as base for a plausibility check of the company’s target figures. The business ratios and results found form the basis for evaluating the company value, which in turn is the source for important decisions for any party involved in the IPO-process. Furthermore, the financial due diligence serves the purpose of identifying important information for the securities prospectus. The company’s strong and weak points are uncovered; chances and risks can be pondered. Finally, the financial due diligence also helps with the analysis whether the company’s current accounting system meets stock trading requirements.

The legal due diligence helps to discover the legal problems and risks existing in the company. In practice, legal counsels will, for one, review relevant documents and, for another, hold talks with the company’s management. In the focus of this review are the corporate circumstances. However, also any significantly important agreements and transactions as well as legal relationships with associated persons form the subject of the legal due diligence. Analysed problem and risk areas may be removed in advance or adequately explained in the securities prospectus. Above all, the legal due diligence is especially important in view of the liability resulting from incomplete or incorrect information given in the securities prospectus.

In the course of a tax due diligence experts check the tax-related circumstances of the company and identify corresponding risks, which are explained in the securities prospectus. Moreover, this analysis serves the purpose of optimizing the structuring of the IPO as regards tax matters. Insofar tax consultants will often be involved in the IPO-process at a very early stage. The results gained from the tax due diligence also play an important role for the presentation of the company in the course of financial reporting.

By means of a market due diligence the issuer and the issuing bank obtain information about the relevant market and the competitors. The first step is the definition and identification of the market segment where the company performs its business activities. Afterwards, the market is analysed. Only after the market review has been completed, the company can be positioned within this market according to its characteristics. In a further step, potential competitors of the issuer are identified and the features distinguishing the company from its competitors are exposed.

Marketing and road show

After an intensive internal preparation, the company, as the next important step, has to communicate its advantages and attractiveness to the market and the investors in order to win them as investors. This requires a targeted and well-planned stock marketing, which customizes the communication means employed to the respective target group.

In the course of an IPO, the most important marketing instrument is the road show. The management team accompanied by the underwriting banks travels from investor to investor to give a first-hand presentation of the company. Usually the road shows will mainly focus on the institutional investors as potential investors.

With the help of a especially prepared presentation, which extensively sets out the company’s business activities and has to be consistent with the securities prospectus, the executive board presents within about 20 to 30 minutes the equity story. Subsequently, the management is available for questions of the investors. Generally the management undertakes one-on-one interviews as well as group presentations. Thus, the potential investors will also get a picture of the trustworthiness of the company’s management as well as of the reliability an the long term capacity of the company strategy.

Depending upon the intended geographic spreading of the stock, investors at various national and international financial centres will be visited. In case of large IPOs such road shows may reach over several continents and take several weeks. This group receives first-hand information from the company in the scope of such roadshow interviews. In addition, the news coverage in the media offers an option to address further investors and to make them interested in a share subscription. Therefore, a good contact with journalists and analysts will prove helpful for the company in this context in order to place information on the market in a targeted manner and to generate attention regarding the emission. The analysts, above all, are of great importance, as they have the task of calculating fair stock prices and illustrating price potentials and price risks.

Internally, the executive managers and the employees of the issuer are an important target regarding the communication process. For one, employees of the company or of affiliated companies may through employee profit-sharing schemes directly hold an interest in the company and may be eligible to subscription. For another, they communicate in their environment on the IPO. Therefore, this investor and multiplier group ought to be informed and attended to in a timely and thorough manner in order to safeguard correct and adequate communication. Additionally, an IPO implicates directly wide changes for a company within the area of communication not at least regarding the regulatory requirements effected by it. Therefore, management and employees should be informed adequately in order to prevent violations of the insider trading ban of the German Securities Trading Act.

Besides the road show, the following measures, above all, can be considered as additional marketing instruments:

- Analysts conferences

- New letters to shareholders

- Interviews, press conferences and media placements

- The investor-relations-website

- Implementation of a call centre (especially for private investors)

- Presentation at investors fairs held by stock exchanges, stock exchange societies and shareholder associations

- Publication of annual reports

- Audio- and video web-casts

- General advertising instruments like advertisements and the like.

Contact Person

Issuer-Hotline

E-Mail: issuerservices@deutsche-boerse.com

Telefon: +49-(0) 69-2 11-1 88 88

Fax: +49-(0) 69-2 11-1 43 33