C7 Releases

Overview of content

- C7 Release 12.1

- C7 Release 12.0

- C7 Release 11.1

- C7 Release 11.0

- C7 Release 10.1

- C7 Release 10.0

C7 Release 11.0

To increase the transparency of software usage, Eurex Clearing will implement a new process for registering Independent Software Vendors (ISVs). Additionally, Eurex will introduce a new process for registering third-party software offered by ISVs and in-house software developed by Clearing Members, which is used to connect FIXML and FpML accounts. Consequently, each Clearing Member and ISV will have to enhance the details on software usage in the Member Section on an account level for FIXML and FpML accounts.

This is a mandatory release for all Clearing Members, Basic Clearing Members, Disclosed Direct Clients and Vendors of Eurex Clearing.

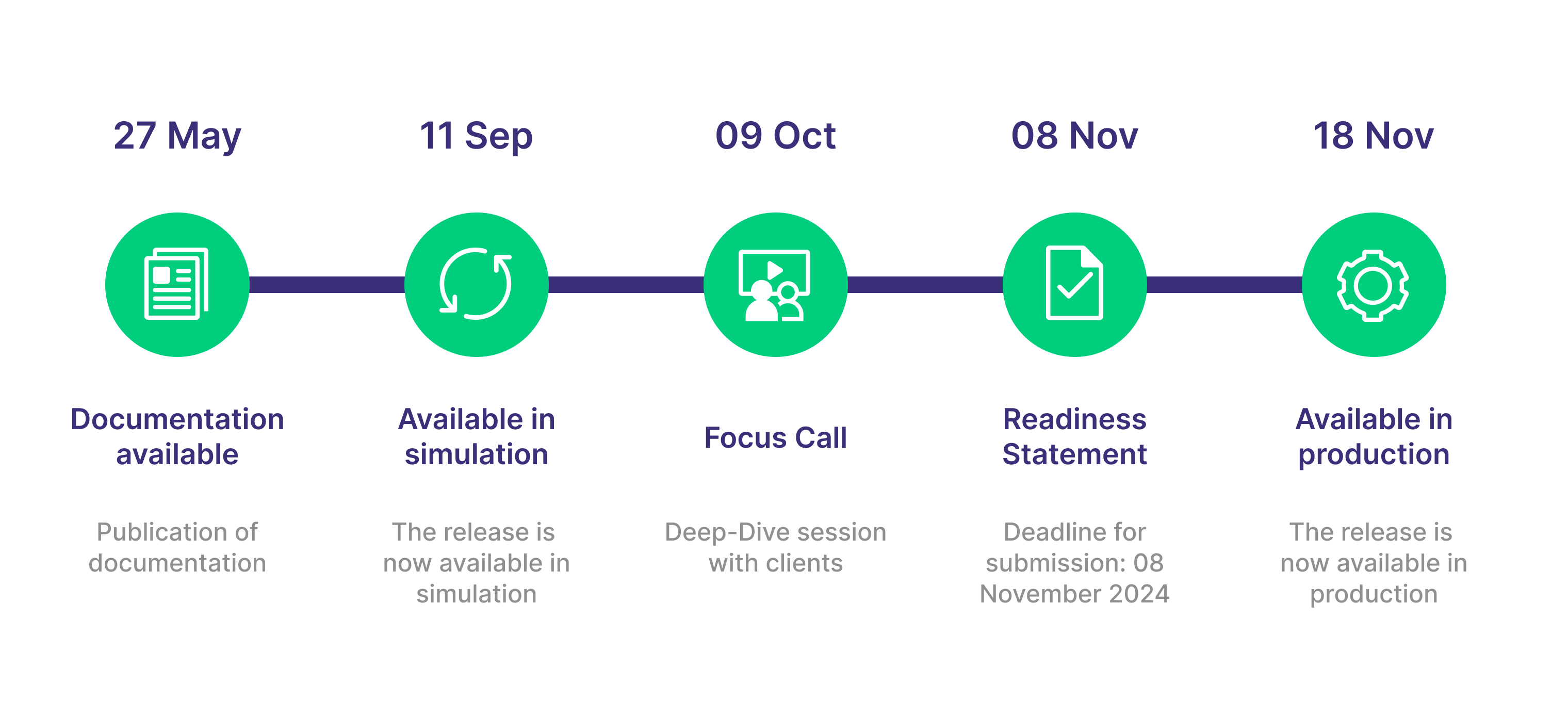

Simulation start: 11 September 2024

Production start: 18 November 2024

System Documentation

- C7 - Advanced Risk Protection Functional Reference Guide (C7 Release 11.0)

Publication date: 17 Jun 2024

This document provides detailed information about the advanced risk protection functionality of C7. - C7 - Collateral Management Functional Reference Guide (C7 Release 11.0)

Publication date: 17 Dec 2024

This document provides detailed information about the collateral management functions of C7. - C7 Member Communication Calendar

Publication date: 27 May 2024

This document provides the publication schedule for C7 member documentation planned in 2024. - C7 Release Notes

Publication date: 27 May 2024

This document gives you an overview of functional and technical enhancements and changes to be introduced. - C7 Release Notes Update

Publication date: 26 August 2024

This document gives you an overview of functional and technical enhancements and changes to be introduced. - C7 Release Notes Update

Publication date: 12 Nov 2024

This document gives you an overview of functional and technical enhancements and changes to be introduced. - C7 Fee Identification Code – User Guide

Publication date: 27 May 2024

This document provides an overview of the different values a Fee Identification Code can take and outlines examples on how to use this information. - C7 Derivatives Clearing Functional Reference Guide

Publication date: 27 May 2024

This document provides detailed information about the transaction and position maintenance functionality of C7. - C7 - User Entitlement Guide

Publication date: 27 May 2024

This document describes the major components of the user entitlement model with the description of each privilege available for entitlement user. - C7 - Reference Data Functional Guide

Publication date: 27 May 2024

This document provides an overview of the reference data and related functionalities maintained in C7.

- C7 - Eurex Clearing FIXML Interface - Schema Files (C7 Release 11.0)

Publication date: 17 Jun 2024

This package contains the schema files for the Eurex Clearing FIXML Interface. The schema describes message structures and fields applicable to position and transaction management on C7, and for public broadcasts. - C7 - File Interface Layouts Manual

Publication date: 27 May 2024

This manual contains the file descriptions for the Currency haircut parameters/adjusted exchange rates and admissible securities. - C7 - Eurex Clearing FIXML Interface Specification - Volume 1: Overview

Publication date: 27 May 2024

Volume 1 contains an overview of the functionality supported by the Eurex Clearing FIXML Interface. - C7 - Eurex Clearing FIXML Interface Specification - Volume 3: Transaction & Position Confirmation

Publication date: 27 May 2024

Volume 3 contains the message layouts for the transaction confirmation and position update confirmation broadcast streams. - C7 - Eurex Clearing FIXML Interface Specification - Volume 4: Transaction & Position Maintenance

Publication date: 27 May 2024

Volume 4 contains all message layouts and workflow descriptions for transaction and position management. - C7 - Eurex Clearing FIXML Interface Specification - Volume 5: Public Broadcasts

Publication date: 27 May 2024

Volume 5 contains public broadcast messages for settlement prices and corrections, end-of-assignment information, contract changes, and corporate action information. - C7 - Eurex Clearing FIXML Interface Specification - Volume 6: Message Samples

Publication date: 27 May 2024

Volume 6 contains sample messages for the Eurex Clearing FIXML interface.

- Eurex Clearing XML Reports – XML Schema Files v.11.0

Publication date: 27 May 2024

This package contains the reports xsd files for C7. - Eurex Clearing XML Reports – Modification Notes

Publication date: 27 May 2024

This document provides an overview of the enhancements and changes to the C7 XML Reports as compared to the previous version. - Eurex Clearing XML Reports – Reference Manual

Publication date: 27 May 2024

This manual provides the XML report descriptions for the Eurex Clearing's C7.

- C7 Clearing GUI - User Manual

Publication date: 28 Nov 2024

This user manual for the Eurex Clearing's C7 Clearing GUI provides final descriptions of all windows and related functions. - C7 Advanced Risk Protection GUI - User Manual

Publication date: 04 Sep 2024

This user manual for the Eurex Clearing's C7 ARP Clearing GUI provides final descriptions of all windows and related functions. -

Clearing GUIs Access Guide 3.10

Publication date: 16 Aug 2024

This document describes the technical requirements to access the Eurex Clearing GUIs: C7 Clearing GUI, EurexOTC Clear GUI and EurexOTC Clear Margin Calculator GUI.

- C7 Release 11.0 Focus Call | Presentation

Publication date: 10 Oct 2024

Circulars

Circulars

- Eurex Clearing Circular 082/24 C7: Production launch announcement of C7 Release 11.0

- Eurex Clearing Circular 037/24 Introduction of C7 Release 11.0

Newsflashes

- Eurex Clearing Readiness Newsflash | C7 Release 11.0: C7 GUI, Exercise and Assignment overview Window - temporary roll-back of changes introduced on Monday, 18 November 2024

- Eurex Clearing Readiness Newsflash | C7 Release 11.0: Readiness Statement available

- Eurex Clearing Readiness Newsflash | C7 Release 11.0: Additional documentation available

- Eurex Clearing Readiness Newsflash | C7 Release 11.0: Update for Member simulation start

- Eurex Clearing Readiness Newsflash | C7 Release 11.0: Update on User ID Deletion in Simulation and Production Environment

- Eurex Clearing Readiness Newsflash | C7 Release 11.0: Update for Member simulation start and C7 Release Notes

- Eurex Clearing Readiness Newsflash | C7 Release 11.0: Additional documentation available

Readiness Statement

We kindly ask all Clearing Members to submit the Readiness Statement for C7 Release 11.0 by Friday, 08 November 2024 latest.

For your convenience a online submission process has been published. The online Readiness Statement is here available: Readiness Statement. Please enter your dedicated Eurex PIN in the online questionnaire. The PIN is available for the Central Coordinator in the Member Section under the following path: My Profile > PIN.

Readiness Videos

FAQ

Technically, these are two separate user IDs even if they belong to the same person and have the same name as ABCFRTRD001. T7 will keep the user ID while C7 will delete it - unless one of the rules favours deletion.

"Outsourcing Relationship Overview" is located in section "Reference Data" under menu point "Participant".

One can allocate the average priced transaction and perform the give-up and take-up. Hence, support for both is required.

There are currently no plans to repeat this deletion at CCP level. If plans change, this will be communicated in due time.

Yes, Field changes (field name, field description, field length) will be relevant for CI042 (Margin Call Report) and CN042 (Night Margin Call Report). All details about the reports can be found in the Prisma 14.0 Report Reference Manual which is available in the Member Section.

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Broadcast VBAP Sub-group details through FIXML interface | The FIXML Allocation Instruction Alert (AIA) message will provide a fee type specific sub-quantity breakdown for remaining allocation quantities. The sub-group will be identified through a combination of "Trade Type", "Trade Publish Indicator" and "Customer Order Handling Instruction". Information at sub-group level quantities will be available in the Clearing report RPTCB716 and can be inquired using the C7 GUI. | Clearing Members are asked to test the FIXML change with new component “AllocGroupSubQtyGrp”. |

Customer Order Handling Instruction (Rate ID) for VBAP Grouping/Allocations | Customer Order Handling Instruction information will be retained in scenarios of VBAP grouping and will be considered while allocation process and relevant pro-rata calculations. C7 will maintain VBAP sub-group transactions for all possible combinations of “Trade Type”, “Trade Publish Indicator” and “Customer Order Handling Instruction”. | Clearing Members are to perform sufficient testing for the following changes:

|

New validation during allocation cancellation | While processing cancel allocations, the application first calculates forecasted (post-cancellation) average price (System Calculated Average Price (SCAP)). | Clearing Members should be aware of the added validation. |

Additional text fields in AllocInst on Allocation + Account transfer | Clearing Members will be able to use FIXML Allocation Instruction message to specify target text fields when requesting Account Transfer for average price transaction(s) out of the VBAP group aligning GUI and FIXML behavior. The already existing text fields in the AllocGrp of the Allocation Instruction message could be used in the future for the Account Transfer. To achieve this, the nested parties for the Target Member and Target Accounts have been moved to the AllocGrp. | The existing FIXML field “AllocGrp” in the AllocInstrctn FIXML message needs to be considered. |

'Ref O/C' mandatory GUI field | The Ref field has to be always filled. The default value will be "O" (open) but can be changed to "C" (close) by Clearing Members. | C7 GUI Change only, no further actions required. |

ARP (Advanced Risk Protection): Email notification in case of level 3 breaches | With this release, a new email service will be introduced in case of level 3 breaches. C7 ARP Members can choose to receive the new service in addition to the current GUI pop-up and FIXML message. Please note that this email service will not be considered as a legally binding form of communication. Due to data protection rules governing the C7 service, only generic email addresses will be permitted, not personal email addresses. | Clearing Members that would like to make use of this service shall contact their Clearing Key Account Manager or send an email to client.services@deutsche-boerse.com. |

Exercise/Assignment overview window changes - additional information on Illogical Exercises | Eurex is planning to enhance the C7 GUI window with additional fields, indicating whether the results are partially or fully exercised/assigned against the position held at the expiry. An IOA indicator column (-in the money, -out the money, -at the money) will be implemented, that also considers the

for OSTK in order to display illogical expectations. | C7 GUI change only, no further actions required. |

GUI User Account Clean up (2nd Step) | As already stated in the C7 10.1 Release Notes (released in December 2023), Eurex plans to perform a system clean-up. All users listed in the “Outsourcing Relationship Overview”

The deletion of the accounts will become effective with C7 Release 11.0 on 18 November 2024. | Clearing Members are asked to check prior to the deletion , if they still require those accounts, which have not been used for over two years. The User Entitlement Maintenance Window will be enhanced to show last activity of the user, day of user creation and initial user. |

Type of Money (ToM) Quota | The transactions (deposit/withdrawal) with ToM “Quota” will be generated to fulfill permanent cash ratio requirements. The cash transaction amounts to meet the permanent cash ratio will be calculated on collateral pool level on a daily basis (EoD values) and will be determined as a difference between the actual delivered cash collateral (Types of Money ‘Blocked’, ‘Term’ and ‘Quota’) and the required cash collateral (total/applicable margin requirements times permanent cash ratio). | New valid value “Q” for the ‘typeOfMoney’ field in C7 Reports CD020, CD080, CD100, CD230, CD231, CI720, CI731, and CD031 must be considered and tested. |

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET