12 Jun 2025

Eurex

Index Total Return Futures: Expansion of TRF Delta Neutral Strategies to the Order Book

1. Introduction

As previously announced in Eurex Circular 037/25, Delta Neutral Strategies for Index Total Return Futures will be activated for the Order Book and T7 Trade Entry Services (TES) within the Production environment as of Monday, 16 June 2025. The list of Delta Neutral Strategy types, input requirements and the Index Total Return Futures on which these strategies will be implemented, plus the related index futures, are detailed below under section 3.

2. Required action

Participants are recommended to completely analyze the potential impact in their internal systems and procedures of the above changes.

3. Details

With T7 Release 13.1 Eurex have introduced additional functionality to support Order Book trading of Index Total Return Futures (TRFs) to complement existing Delta Neutral TAM (Delta TAM) trades which were launched for T7 Trade Entry Services (TES) in April 2024 (Eurex Circular 039/24). Implementation of this functionality is via the introduction of a new Complex Instrument type and its respective subtypes.

In line with common market practice and existing handling via TES, the new functionality will allow the simultaneous trading in the Order Book of an Index TRF and the delta hedge of the equity exposure, which is achieved via the opposite directional trade in the regular Index Future (as a proxy on the cash index basket) resulting in the isolation of the implied equity repo.

Order Book Delta Neutral TRF strategies will also be introduced, in line with the two existing trade types for Index TRFs Trade at Market (TAM) and Trade at Close (TAC). TAM trading is currently only available in T7 Trade Entry Services (TES) but is the prevalent Order type, as this trade type is often done in conjunction with the regular Index Futures and at a specific index “strike” or custom index level, which is entered by participants.

The regular Index Futures are traded directly in combination with the Index TRFs or accessed via the Index Market-on-Close (MOC) Futures, to facilitate the two types of delta hedge required in combination with the Index TRF trade types (i.e. either in relation to the spot market level or the index close).

DELTA-TAM strategy is the simultaneous execution of an Index TRF Trade at Market (TAM) and the corresponding hedge in the regular Index Future in a single trade. The underlying strike (Custom Underlying Index) applicable to the Index TRF is determined at the point of trade, based on the index basis provided by the market participants and the price of the executed regular Index Future.

Execution is available in the Order Book or in T7 Trade Entry Services (TES). On-screen pricing in the strategy is in basis points as per the Index TRF convention and will be visible in the TRF Order Book.

For participants to populate the strategy additional information is required:

- The exchange for physical (EFP) index basis between the cash index level and the regular Index Future (expressed in index points in the Eurex convention of “regular Index Futures – Cash Index level”),

- The TRF contract and maturity and the related regular Index Future maturity (note the related contract is pre-defined).

Upon execution this EFP index basis will be used in conjunction with the executed regular Index Futures price to determine the underlying index strike used in execution of the Index TRF.

Determination of the regular Index Futures price at execution can be either:

I. the regular Index Future price is determined by the T7 trading system based on the current market level of that Index Future in its own corresponding Order Book, referred as DELTA-TAM-Regular-Market (“DTAM-RM”) and available only in the Order Book; or

II. a pre-determined fixed price entered by the participant for the regular Index Future entered as part of the strategy by the participant and referred as DELTA-TAM-Regular-Fixed (“DTAM-RF”).

To be noted that under DTAM-RM, the executed related Index Futures leg of the strategy will not interact directly with that instruments Order Book.

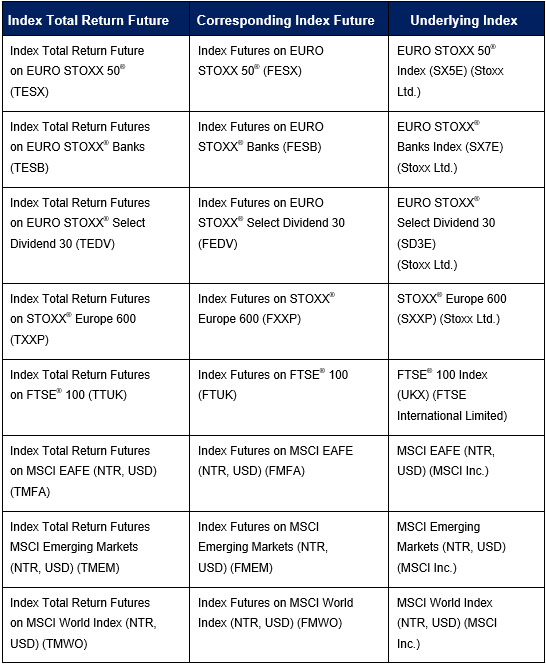

The Index Total Return Futures and the related regular Index Future and the corresponding underlying Index are detailed below:

Note: The corresponding ratio in all the above will be on a 1:1 basis.

b. Delta-Neutral Trade at Close (DELTA-TAC)

DELTA-TAC strategy is the simultaneous execution of an Index TRF Trade at Close (TAC) and the corresponding hedge in the Index Market on Close (MOC) Future in a single trade. The underlying strike level applicable to the Index TRF and the Index Level used in conjunction with the Index MOC Future are based on the daily Official Index Close.

Execution is available in the Order Book or in T7 Trade Entry Services (TES). On-screen pricing in the strategy is done in basis points as per the Index TRF convention and will be visible in the TRF Order Book.

Determination of the Index MOC Futures price at execution can be either:

I. the Index MOC Future level is determined by the T7 trading system based on the current market level of that future in its own Order Book; referred as DELTA-TAC-MOC-Market (“DTAC-MM”) and available only in the Order Book; or

II. a pre-determined fixed price entered by the participant for the Index MOC Future in index points referred as DELTA-TAC-MOC-Fixed (“DTAC-MF”).

To be noted that under DTAC-MM, the executed Index MOC Futures leg of the strategy will not interact directly with that instruments Order Book.

The Index Total Return Futures and the related Index Market-on-Close Future and the corresponding underlying Index are detailed below:

Note: The corresponding ratio in the above will be on a 1:1 basis.

B. Technical documentation

Eurex T7 Release 13.1 documentation can be found at the Eurex website www.eurex.com under the link:

Support > Initiatives & Releases > T7 Release 13.1

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Related circulars: | ||

Contact: | Stuart Heath, Equity & Index Product Design, tel. +44-207-862-72 53, stuart.heath@eurex.com; | |

Web: | www.eurex.com | |

Authorized by: | Jonas Ullmann |