Your liquidity hub for cleared FX

With Eurex FX, you can optimize your FX portfolios and mitigate the impact of UMR and SA-CCR capital requirements. FX investors who traditionally relied on OTC FX markets now discover FX futures as a tool to protect their portfolios from increasing costs stemming from counterparty risk and related regulations.

Eurex offers access to its cleared FX liquidity hub. You can tap into the liquidity streamed into our central limit order book (CLOB). Or you can leverage your bilateral trade relationship by asking for prices from your preferred dealers directly. Eurex is on a mission to provide full electronic access to cleared FX liquidity, letting you seamlessly integrate FX futures into your existing OTC FX workflows.

Buy-side perspectives on FX

Survey report: Insights from 120 buy-side leaders on emerging trends in FX

Central Limit Orderbook

Eurex offers trading in the CLOB, where participants interact anonymously with access to streamed prices by various bank and non-bank liquidity providers. Additionally, buy-side users can enter quotes themselves and, therefore, save the spread.

OTC traded yet centrally cleared

Eurex participants can trade FX futures directly with their OTC counterparties. Clients can request prices from their dealers and trade in an OTC-style fashion on a fully disclosed basis. This mirrors OTC market practices and offers clients/participants seamless access to cleared FX liquidity to optimize their portfolios. As in OTC markets, clients can trade with their dealers directly or utilize FX platforms such as 360T to manage all their trading relationships.The most common instruments for trading FX futures in an OTC-style fashion are block trades and EFPs – both of which will result in centrally cleared FX positions.

FX EFPs

Exchange for physicals (EFPs) are an off-book transaction model connecting OTC and ETD FX markets: establish an OTC FX position and easily convert it into a cleared FX futures contract. With EFPs, you can take advantage of OTC liquidity while establishing a cleared FX position. And there is a growing network of dealers offering highly automated execution services based on EFPs. Read more here: Exchange for Physicals (eurex.com).

FX block trades

A block trade allows market participants to privately negotiate the price bilaterally and has traditionally been used for larger transactions. Because we do not set any minimum thresholds for block trades in FX on Eurex, they are the ideal tool for risk transfer of any size. You can fully leverage your existing OTC relationships and add the bank and non-bank liquidity providers available in the Eurex FX network. For further information go to: Block Trades (eurex.com).

Eurex FX Futures: Traded Contracts and Open Interest

Key benefits

Why FX futures?

- Easy access and widely available

- Multilateral netting optimizes portfolios under UMR

- Highest capital savings (e.g., under the SA-CCR framework)

- Lowest margin period of risk minimizes funding requirements

- You can still maintain bilateral relationships through trading block trades and EFPs

Why on Eurex?

- Portfolio optimization under SA-CCR and UMR

- Highly competitive exchange fees

- Experts in European pairs and deep liquidity

- Efficient funding through our collateral solutions

RFQ platforms

Eurex is driving the electronification of FX futures. We aim to provide cleared FX products in existing FX and RFQ platforms, enabling easy access for our clients.

Our listed FX derivatives are currently available through the following RFQ platforms:

- 360T

- RFQ Hub

- Eurex EnLight

FX Futures

- FX Futures are comparable to OTC FX forwards but have significantly lower counterparty credit risk (CCR) as financial obligations are guaranteed by a central counterparty (CCP).

- FX Rolling Spot Futures are perpetual contracts that mimic the trading of an OTC FX spot, combined with a daily usage of tom-next (T/N) points at MID, to roll over the position.

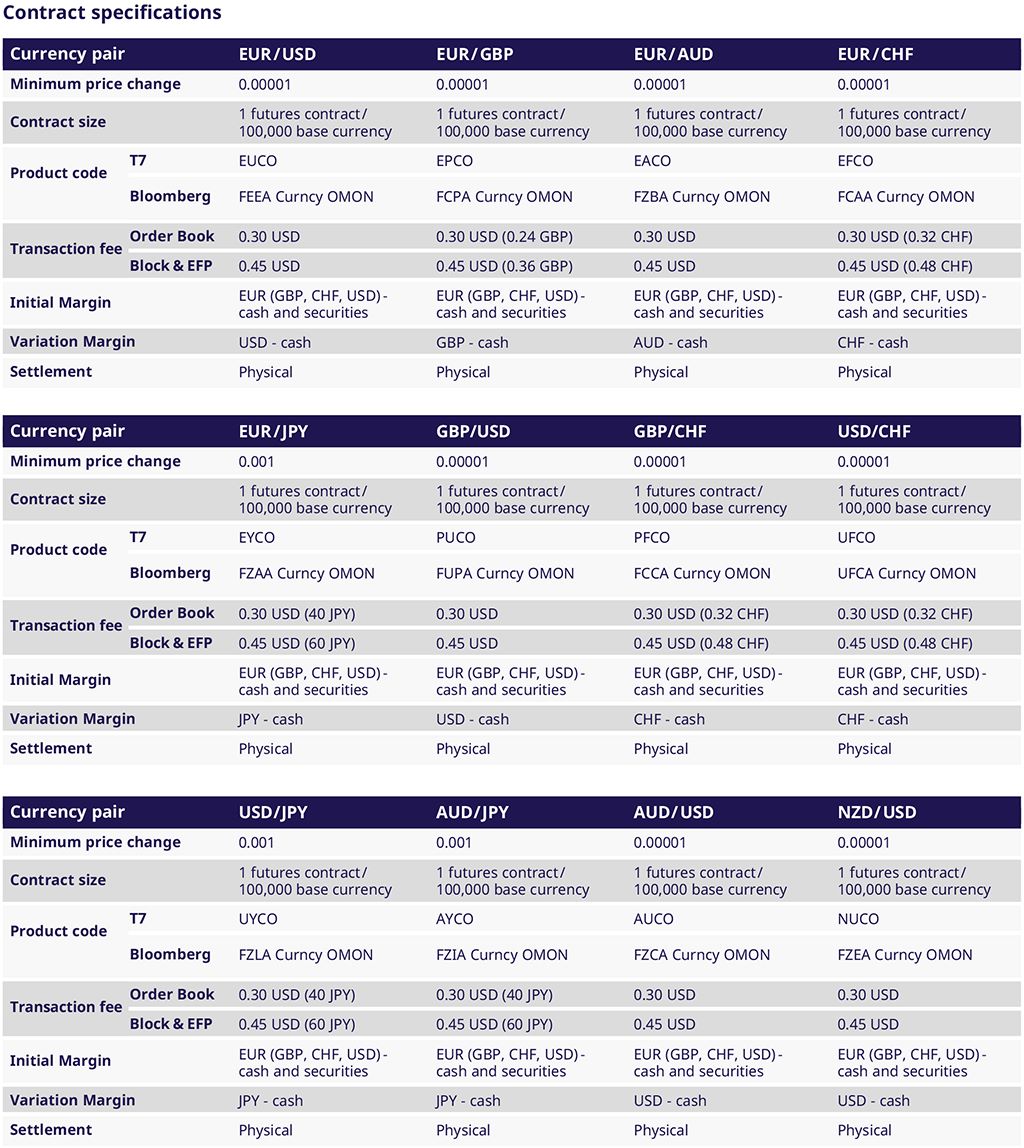

Contract specifications

Product code | Transaction fees | |||||||||

Currency pair | Min price change | Contract size | T7 | Bloomberg | Reuters | Order book | Block & EFP | |||

G7 USD | ||||||||||

EUR/USD | 0.00001 | EUR 100,000 | FCEU | FEEA Curncy | 0#FCEU | USD 0.30 | USD 0.45 | |||

GBP/USD | 0.00001 | GBP 100,000 | FCPU | FUPA Curncy | 0#FCPU | USD 0.30 | USD 0.45 | |||

AUD/USD | 0.00001 | AUD 100,000 | FCAU | POLA Curncy | 0#FCAU | USD 0.30 | USD 0.45 | |||

NZD/USD | 0.00001 | NZD 100,000 | FCNU | PODA Curncy | 0#FCNU | USD 0.30 | USD 0.45 | |||

USD/CHF | 0.00001 | USD 100,000 | FCUF | UFCA Curncy | 0#FCUF | USD 0.30 | USD 0.45 | |||

USD/JPY | 0.001 | USD 100,000 | FCUY | POYA Curncy | 0#FCUY | USD 0.30 | USD 0.45 | |||

USD/CAD | 0.00001 | USD 100,000 | FCUC | CYBA Curncy | 0#FCUC | USD 0.30 | USD 0.45 | |||

G7 crosses | ||||||||||

EUR/AUD | 0.00001 | EUR 100,000 | FCEA | POPA Curncy | 0#FCEA | USD 0.30 | USD 0.45 | |||

EUR/CHF | 0.00001 | EUR 100,000 | FCEF | FCAA Curncy | 0#FCEF | USD 0.30 | USD 0.45 | |||

EUR/GBP | 0.00001 | EUR 100,000 | FCEP | FCPA Curncy | 0#FCEP | USD 0.30 | USD 0.45 | |||

EUR/JPY | 0.001 | EUR 100,000 | FCEY | POTA Curncy | 0#FCEY | USD 0.30 | USD 0.45 | |||

GBP/CHF | 0.00001 | GBP 100,000 | FCPF | FCCA Curncy | 0#FCPF | USD 0.30 | USD 0.45 | |||

AUD/JPY | 0.001 | AUD 100,000 | FCAY | POBA Curncy | 0#FCAY | USD 0.30 | USD 0.45 | |||

EUR/CAD | 0.00001 | EUR 100,000 | FCEC | CFBA Curncy | 0#FCEC | USD 0.30 | USD 0.45 | |||

EUR/NZD | 0.00001 | EUR 100,000 | FCEK | CFAA Curncy | 0#FCEK | USD 0.30 | USD 0.45 | |||

Scandinavia | ||||||||||

EUR/NOK | 0.00001 | EUR 100,000 | FCNK | FKOA Curncy | 0#FCNK | USD 0.30 | USD 0.45 | |||

EUR/SEK | 0.00001 | EUR 100,000 | FCSK | FKPA Curncy | 0#FCSK | USD 0.30 | USD 0.45 | |||

EUR/DKK | 0.00001 | EUR 100,000 | FCDK | FKDA Curncy | 0#FCDK | USD 0.30 | USD 0.45 | |||

USD/NOK | 0.00001 | USD 100,000 | FCUN | UKTA Curncy | 0#FCUN | USD 0.30 | USD 0.45 | |||

USD/SEK | 0.00001 | USD 100,000 | FCUS | UKPA Curncy | 0#FCUS | USD 0.30 | USD 0.45 | |||

USD/DKK | 0.00001 | USD 100,000 | FCUD | UKBA Curncy | 0#FCUD | USD 0.30 | USD 0.45 | |||

NOK/SEK | 0.00001 | NOK 1,000,000 | FCNS | KKOA Curncy | 0#FCNS | USD 0.30 | USD 0.45 | |||

Emerging markets | ||||||||||

ZAR/USD | 0.00001 | ZAR 1,000,000 | FCZU | BJDA Curncy | 0#FCZU | USD 0.30 | USD 0.45 | |||

ZAR/EUR | 0.00001 | ZAR 1,000,000 | FCZE | BJEA Curncy | 0#FCZE | USD 0.30 | USD 0.45 | |||

MXN/USD | 0.00001 | MXN 1,000,000 | FCMU | BJBA Curncy | 0#FCMU | USD 0.30 | USD 0.45 | |||

MXN/EUR | 0.00001 | MXN 1,000,000 | FCME | BJCA Curncy | 0#FCME | USD 0.30 | USD 0.45 | |||

BRL/USD | 0.00001 | BRL 1,000,000 | FCBU | BJOA Curncy | 0#FCBU | USD 0.30 | USD 0.45 | |||

Options on FX Futures

- Options on FX Futures are standardized monthly options that allow users to manage risk or gain exposure to FX volatility with the counterparty risk protection of a CCP.

Regulatory considerations

- SA-CCR: Directional and uncollateralized portfolios are becoming more costly for banks under the SA-CCR framework. These are costs that banks typically pass on to clients. Cleared FX futures benefit from the lowest regulatory capital requirements under SA-CCR.

- UMR: FX futures help to optimize uncleared portfolios. FX futures enable clients to reduce the uncleared exposure below regulatory thresholds (such as the EUR 8 billion average aggregate notional amount).

- Counterparty credit risk: FX futures eliminate counterparty credit risk, even when traded directly between clients and their banks on a fully disclosed basis. This becomes ever more important in an environment of increasing uncertainty and counterparty defaults.

Don't want to miss updates on Eurex FX?

Sign up for our newsletter on FX highlights, product launches and extensions, as well as news on events and recommended reads

Contact

FX Sales

Frankfurt

T +49-69-211-1 26 19

London

T +44-20-78 62-76 64

Chicago

T +1-312-544-1056

E-Mail

fx@eurex.com

For immediate operational issues, please refer to the respective hotlines.

*Note: due to regulatory restrictions, Eurex Clearing AG is currently not able to offer NDF clearing services in the United Kingdom and the U.S. until further notice.