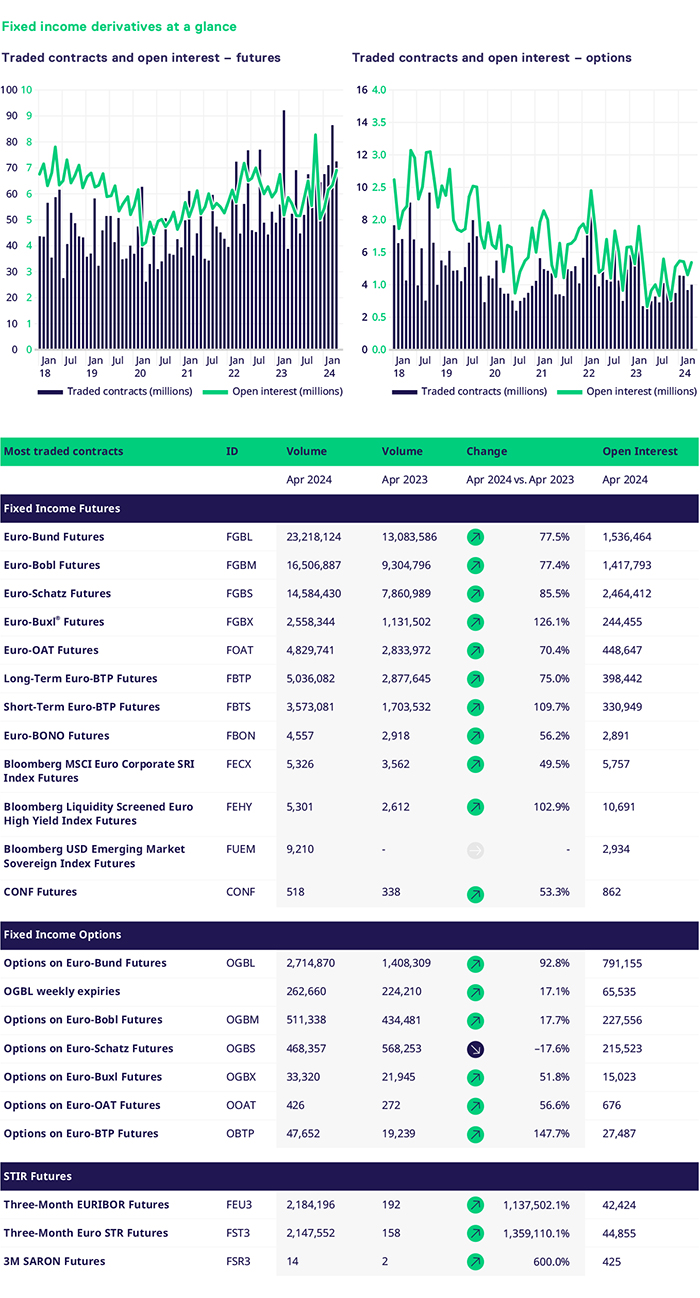

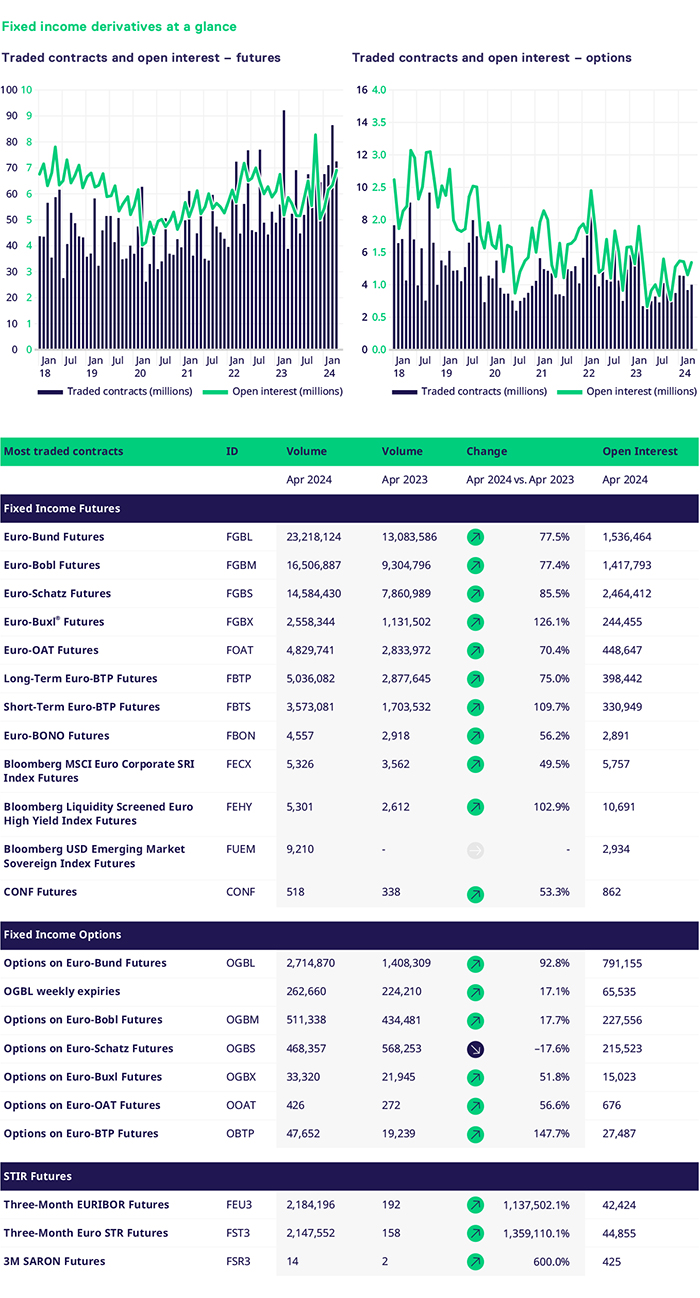

Records are there to be challenged and surpassed. April was a record for Eurex across our FIC business. The core portfolio continued to outperform, with solid double growth across the board. This was largely driven by a supportive macroeconomic backdrop, heightened event risk and increased expectations of central bank divergence. For this month’s update, I will keep the commentary to a minimum and focus on other areas of note from the month. In short, we continue to be grateful for the support shown by our members, clients, and liquidity providers (LP) in growing our core franchise and helping us develop new markets.

A highlight has been the continued growth in our STIR segment. IMHO, one of the team’s strengths is focusing on the task at hand, our performance, and how it supports our medium-term objectives. April was a continuation of this. Specifically, we listened to our members and made changes to our LP scheme, which positively impacted the STIR segment. We saw solid open interest growth while maintaining consistency in our volume development. One of the team’s overarching principles, which is very much applicable to our approach in this segment, is ‘Don’t aim to be consistently great. Aim to be great at being consistent.’ We carefully build out this important portfolio segment, and it will take time, something we are committed to as a team. With respect to introducing ESTR options, the team is committed to achieving this important milestone. However, we feel OI doesn’t just need to go through 100k; there needs to be depth in OI across the white expiries to ensure consistency of trading, liquidity and credibility.

Credit continues to be a segment that is gaining momentum. We continue to see strong client activation and we are keen to launch USD as soon as possible. This is a segment that the team strongly believes in and one where we believe the benefits of multicurrency outweigh a single-currency approach. ‘I need to listen well so that I hear what is not said.’ We remain committed to listening to our clients in this manner and will add underlyings to help strengthen the portfolio, albeit our immediate focus is on building out the volumes, thus creating critical mass. Speaking of which, our newly launched USD Emerging Market Sovereign index futures continue to show steady and consistent growth, trading close to 10,000 contracts in April, corresponding to about USD 200mn in notional. Along these lines, Euro High Yield index futures saw the largest Block Trade ever priced, trading in one go over 1,800 contracts – this is over EUR 100mn in notional.

Lastly, April saw us hold our first derivatives working committee of the year, which proved to be the best one I have participated in since joining the business. The level of engagement by our members provided a lot of insights and gave us lots to work on for the remainder of the year. The team was truly thankful for the support shown and the active engagement. The team did so well in putting such an engaging agenda together. May is shaping up to be another solid month, positioning the business for a strong Q2.